Voters in Seattle have been heavily broken in favour of funding new public housing in the city, and so far have leaned towards doing so with new taxes on well-paid businesses.

The results represent the overwhelming victory of those who fought to tap Seattle wealth and build more housing and public services if they hold in the coming days. He also replied with City Hall and Seattle’s metropolitan chamber of commerce, urging voters to reject new taxes in favor of using existing urban dollars for new homes.

Voters were asked two questions. First, should Seattle social housing developers receive funding? Second, should the money come from new taxes on companies whose employees make more than $1 million a year, or from money brought by existing taxes on companies based in Seattle?

In voting drops on Tuesday evening, voters said yes to funding developers with a healthy 68% of the vote.

In the second question, almost 58% of voters wanted to enact a new tax, while 42% wanted to use existing funds.

Seattle elections are rarely decided on election night, and votes later generally break more against progressive causes and candidates. It could be late on Friday or until next week before the final results are focused.

That said, the results appear to support the new tax.

Tiffani McCoy, a spokesman for the House House Our Neighbors campaign, in support of the new tax, calling the results on Tuesday a “overwhelming victory.”

“Voters are tired of progressivism. They are tired of waiting for the housing crisis to be addressed,” she said. “They want it to be dealt with completely, they want it to be dealt with now.”

Chamber of Commerce CEO Rachel Smith said he will continue to monitor vote counts in the coming days.

The final outcome of Tuesday’s election will determine whether Seattle has another bit player or a new hero in the city’s network of housing providers.

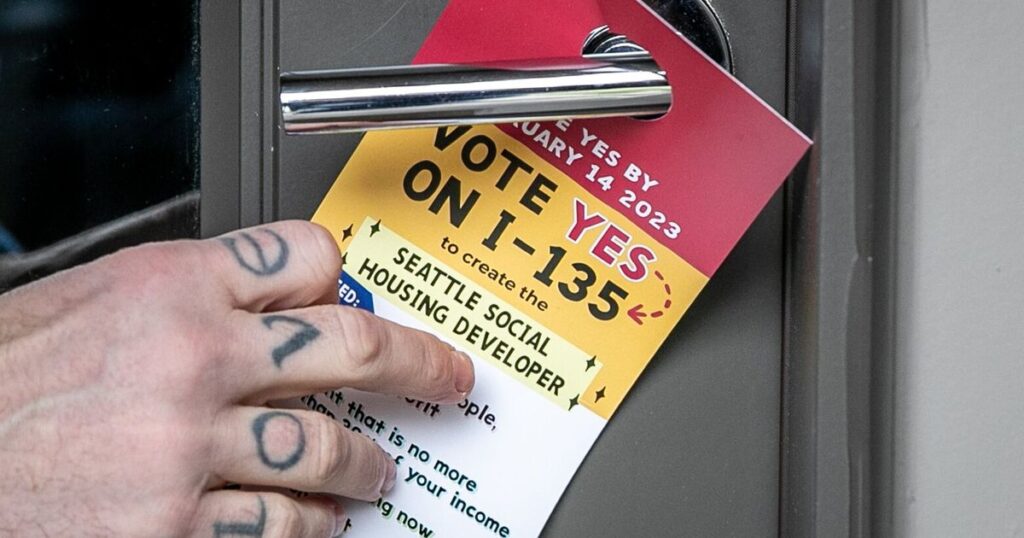

Tuesday’s special election was a follow-up to the election two years ago, greenlighting the creation of a publicly owned home developer.

The developer’s goal is to provide mixed-income housing, primarily for working families who fear priced from Seattle. This is a Vienna vision of housing aimed at bridging the gap between commercial builders of luxury homes and developers of deep, affordable housing for people who make little money. is. The home will be open to public and will fall below the permanent market rate.

If executed properly, housing will hold people of varying incomes, and wealthy residents will subsidize the total costs of the poor. The supporters hope that Body, led by CEO Roberto Jimenez, can guarantee the future of teachers, restaurant workers, merchants and others who struggle to live where they work. Masu.

But skeptics doubt that the body is ready for such a huge sum of money, especially in cities with many experienced, nonprofit housing developers. In the midst of a homeless crisis, there is a question of why urban dollars should be spent on labor housing.

Due to state restrictions on the scope of voter initiatives, when the developer was created in 2023, there was no source of funding. Checks from Seattle and the state government rolled the ball on management tasks after a major delay, but the developer’s central mission to buy or build a home is in scope.

The 2023 victory campaign launched a signature collection effort to enact a 5% tax on all salaries for employees making more than $1 million a year. For example, if an employee makes $1.1 million, the company would pay 5% tax on a $100,000 salary. Supporters estimated they would raise $50 million a year.

The campaign was a success. However, the Seattle City Council has determined that it wanted competing measures at the request of the Chamber of Commerce. The second option would dedicate $10 million from the city’s existing taxes to large businesses aimed at affordable housing to fund developers rather than creating new taxes. Masu.

The battles since then have been like a proxy war between the left and the more moderate wing of Seattle politics. New tax advocates see it as a way to rely on the city’s wealthiest businesses to mitigate the housing crisis. Supporters of the second option claim that the city’s financial resources are already overpacked and question whether new developers are well prepared and accountable to spend that much of their money each year. I’m doing it.

Developer opponents see it as the dollar that could siphon the dollars from the housing needed for the city’s lowest-income residents.

The spending is intense. Microsoft and Amazon each agreed to spend $100,000 and spending their existing dollars.

The House Our Neighbors campaign, a campaign in favor of the new tax, raised $600,000. Most of it comes from the Inatai Foundation, a foundation that aims to provide grants that have been sold to Kaiser Permanente and “community-oriented, equity-focused.”