BBC

BBCHeading to the US grocery store, shelves stocked jars of St. Dalfour Strawberry Spread and Bonne Maman Raspberry Jam. There is more than $200 million (£154 million) of jams that Europe sends to the US each year.

But try looking for American-made jelly in Europe. That way you could be short.

The US exports jams under $300,000 (£231,000) to the block each year.

It is unbalanced for JM Smucker, one of the biggest sellers of such products in the United States, to blame the import tax of over 24%, which is spreading import taxes of over 24% to the EU.

“The small value of US exports to the European Union is entirely attributable to the high EU tariffs,” the company wrote in a letter to the White House this month.

“The US retrograde tariffs on EU jams and jellies will help level the playing field,” the company said, noting that the highest US jam tariff is currently at 4.5%.

Globally, the push for Trump to deploy tariffs on close trading partners — many of which have average tariff levels similar to those in the US — has issued warnings from economists about higher prices and other potential economic pain.

While some US companies reflect these concerns, Trump’s tariff calls have long been frustrated with foreign competition and policies that many companies face overseas.

Smucker’s letter was one of hundreds filed with the White House seeking to affect the next tariff, which is expected to be released on April 2nd.

Apple Farmers has caused a huge gap in import duties facing fruits in countries such as India (50%), Thailand (40%) and Brazil (10%).

Streaming companies flagged the digital taxes in Canada and Türkiye, saying they “unfairly target and discriminate” against US companies.

The oil and natural gas lobby criticized Mexican regulations, which require partnerships with state-owned oil companies and other policies.

The White House itself has highlighted Brazil’s uneven ethanol tariffs (18%, compared to 2.5% in the US), European auto tolls (compared to 2.5% in the US), and Indian motorcycles (until a few years ago, 100% vs. 2.4% in the US).

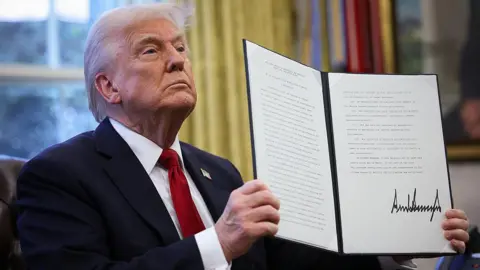

Trump suggests that mutual tariff plans will help to alleviate such complaints and will help send out his announcement as “Day of Liberation.”

But even companies seeking action on their issues have expressed hesitation about the president’s tariff first, the strategy of questioning and claiming.

With April 2 approaching, broad uncertainty remains, especially as Trump launches more obligations.

“We’re going to be great,” he said this week as he announced potentially devastating tariffs on foreign cars and car parts. “I think people will be happy and surprised.”

India has already said it will lower motorcycle tariffs – an obvious bet that Trump tariffs are a strategy designed to gain leverage in trade talks.

However, analysts warned that those who wish Trump plans to use his mutual tariffs to negotiate change elsewhere may be disappointed as the president has shown he will be satisfied by simply fighting back.

“One day is about revenge and equalization, the other day is about lowering tariffs, and the other day, the third day, that’s about bringing manufacturing to the US,” said William Reinsh, senior advisor to the Center for Strategic and International Studies, a Washington think tank.

“He uses them all at different times. There’s no single thread here that you can rely on.”

Getty Images

Getty ImagesThe discrepancy between the dull tools of tariffs and more niche issues, as companies have led to delicate dances to the White House, as companies have led to delicate dances to champions, hopes to avoid the impact of drastic obligations like Trump suggests.

For example, North Star Bluescope Steel, a steel manufacturer that employs 700 people from recycled metals, has urged Trump to expand steel and aluminum tariffs to parts.

However, at the same time, they sought an exemption from the necessary raw materials, such as scrap metal.

Similarly, the lobby group of JM Smucker and other large food manufacturers, Consumer Brands Association, warned against “overly wide and swept tariffs,” which could make it more expensive for members to import ingredients such as Cocoa, which are not made in the US.

“We don’t necessarily want to impose tariffs on the current administration,” Tom Madrekki, vice president of the supply chain resilient group, said in a recent forum on tariffs hosted by farmers for free trade.

“It’s a careful balance between yes. I want America’s first trade policy and action to counter unfair trade policies overseas…but it may not be.”

Wilbur Ross, who served as Trump’s Secretary of Commerce in his first term, said he called April 2 a “big step” as business worries would fade away as Trump’s plans became clear.

However, he said he saw the president as having little lack of using tariffs and viewing them as either a new source of revenue or a way to reduce imports and encourage more production.

“He’s very committed,” Ross said. “People should have known this was coming because he’s been talking about it over the years.”

Traditionally pro-trade party Republicans have continued to support Trump’s strategy despite being criticised for recent stock market sales and weaknesses in research into business and consumer trust.

At a recent trade hearing, Rep. Jodie Arlington, a Republican representing Texas, admitted that there may be “front-end-related pain,” but that maintaining Trump’s focus on the issue would ultimately create opportunities for his electoral.

“It seems like it’s not Americans that American manufacturers, producers and workers don’t fight simply to have a uniform arena,” he said.

“We’re just trying to reset those relationships to play with the same set of rules,” he added. “Then everyone wins.”