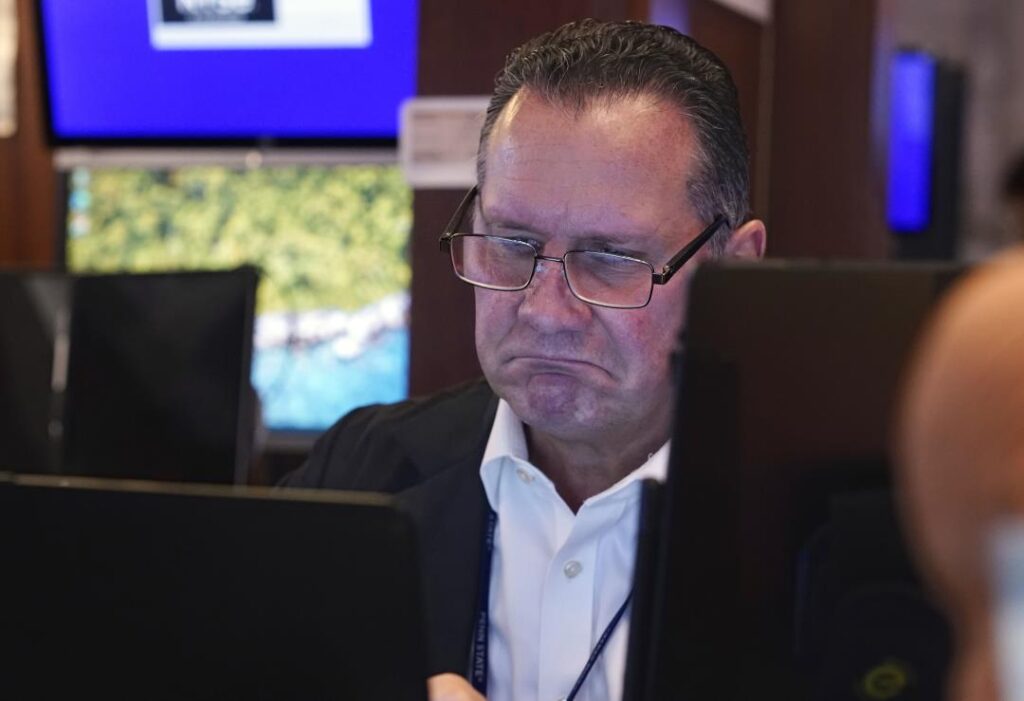

Barring a late reversal, the Dow is poised for nine straight days of declines, a record not seen since the 1970s. The index was down more than 200 points in mid-afternoon trading. The last time the Dow Jones Industrial Average lost nine days in a row was in February 1978, CNN reported. Still, the decline has been fairly modest, with the index down about 3% over the past eight days. Additionally, while the benchmark S&P 500 and the tech-heavy Nasdaq remain generally strong, both companies were in the red on Tuesday.

CNBC notes that the Dow’s losing streak began after the index closed above $45,000 for the first time, ending a strong run following Donald Trump’s election victory. “Wall Street is starting to wake up to the fact that President Trump’s inauguration may not be as good for stocks as some people expected,” said David Russell of TradeStation. “While finance and industry jumped on his victory, they may now have to face rising interest rates and trade uncertainty, with the healthcare industry facing its biggest political risk in recent memory. ” (Other stock market stories.)