New Delhi:

Stock markets around the world have sunk after President Donald Trump announced that tariffs in Mexico and Canada would be implemented as planned. Trump’s comments on Monday hit fears of a trade war in North America and shook financial markets. US stocks fell sharply in late afternoon trading, with Mexican pesos and Canadian dollars falling too.

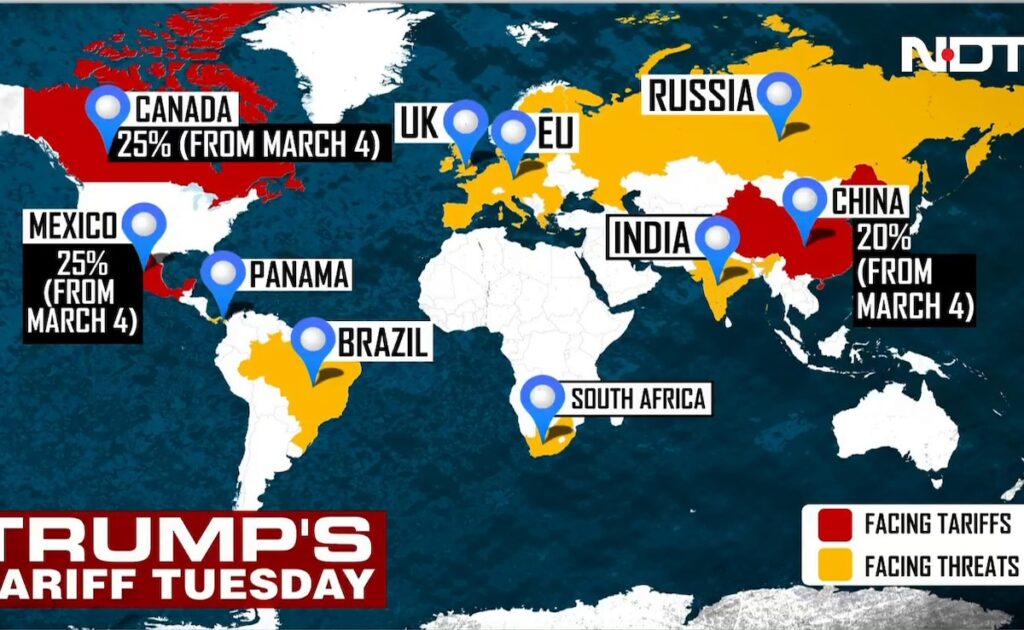

The US president said 25% of US tariffs on imports from Canada and Mexico will come into effect from Tuesday after a 30-day suspension on duties linked to illegal border crossings and the flow of fentanyl to the United States. Americans have also reaffirmed that tariffs on all Chinese imports would be increased to 20% from the past 10% collection to punish Beijing for not halting shipments of fentanyl to the US.

What did Trump say?

“They’ll need to have tariffs, so all they have to do is, frankly, build their car plants, and others in the US.

He said there were “no rooms left” because of a transaction that would avoid tariffs by throttling the fentanyl flow to the United States.

On hiking tariffs on all Chinese imports, the president said Beijing “has not taken appropriate measures to alleviate the illegal drug crisis.”

The duties are expected to take effect at 12:01am (0501 GMT) on Tuesday, the Trump administration confirmed in a notification on the federal register. At that point, the U.S. Customs and Border Protection Agency will begin collecting 25% of Canadian and Mexican goods with a 10% obligation on Canadian energy.

Trump has long argued that tariffs are useful tools to correct trade imbalances and protect US manufacturing. It dismisses concerns that the measures will risk economic damage to the US, especially despite close ties in North America where businesses enjoy decades of free trade.

Trump’s tariffs on Canada and Mexico cover more than $900 billion in annual US imports, and will deal with a serious setback in the highly integrated North American economy, according to CEOs and economists.

Canada, Mexico and China respond

Mexico’s economy ministry said there would be no public response until President Claudia Sinbaum’s regular morning press conference on Tuesday. On Monday, she appeared to send a message to Trump when she said “Mexico must be respected” at a public event in Colima.

She vowed to respond by saying, “I have plans B, C, D.”

Canadian Foreign Minister Melanie Jolly told reporters that Ottawa was ready to respond but did not provide details.

Ontario Prime Minister Doug Ford told NBC that US tariffs and Canadian retaliation would be an “absolute disaster” for both countries. “I don’t want to respond, but I’ll respond like they’ve never seen it before,” Ford said, adding that Michigan’s car factory will be closed within a week and will stop shipping nickel and transferring electricity from Ontario to the US.

“I’m absolutely chasing everything,” Ford said.

Meanwhile, China’s state-run Global Times newspaper said Beijing has prepared measures.

The market is swelling

Three major US metrics sank after Trump’s comments. The Dow Jones industrial average finished 649.67 points (1.48%), the S&P 500 lost 104.78 points (1.76%), and the Nasdaq Composite fell 497.09 points, or 2.64%. The epic 7-mega cup gauge sank 3.1%. UBS baskets of US stocks affected by 2.9% sunk tariffs.

The markets in Asia and Australia are also effective, and are shared by Tokyo, Hong Kong and Sydney. The benchmark Nikkei 225 index plummeted 2.43%, while the broader Topix index lost 1.48%.

Indian stocks also opened on Tuesday, tracking down their Asian peers. The Nifty 50 fell 0.64%, falling to 21,979.85 by 9:15am, with BSE Sensex losing 0.45% at 72,753.64.

All 13 major sectors recorded losses in open, while the wider smaller and medium caps each reduced by about 1%. MSCI Asia Ex-Japan fell by about 0.6%, tracking an overnight decline in Wall Street stocks.

Investors are increasingly wary of rising geopolitical tensions and the prospects for The-Tat tariffs that exacerbate global trade spats.

The automaker’s stocks fell sharply, with a significant truck production in Mexico, down 4% and Ford down 1.7%.

Gustavo Flores Masias, a public policy professor at Cornell University, said consumers will be able to see prices rise within days.

“The automotive sector in particular is likely to see substantial negative outcomes as we expect not only disruptions in the supply chain across three countries in the manufacturing process, but also increases in prices for vehicles that could reduce demand,” Flores-Macias said.

Trump’s mutual tariff plan

Last week, Trump ordered a revival of tariff investigations in countries collecting digital services taxes, suggesting a fee of up to $1.5 million for every Chinese-made vessel entering US port, and launched a new tariff investigation into copper imports.

These come in conjunction with other countries’ tariff rates and come in addition to the US’s high “mutual tariff” plan to offset other trade barriers.

But Trump’s “tariffs on steroids” could keep inflation high and bring the global economy into a recession, warned Desmond Luckman, a senior fellow at the conservative American Enterprise Institute.