WASHINGTON (AP) – The Trump administration ordered Consumer Financial Protection Bureau To halt almost all work, effectively shut down institutions created to protect consumers after the 2008 financial crisis and the subprime mortgage lending scandal.

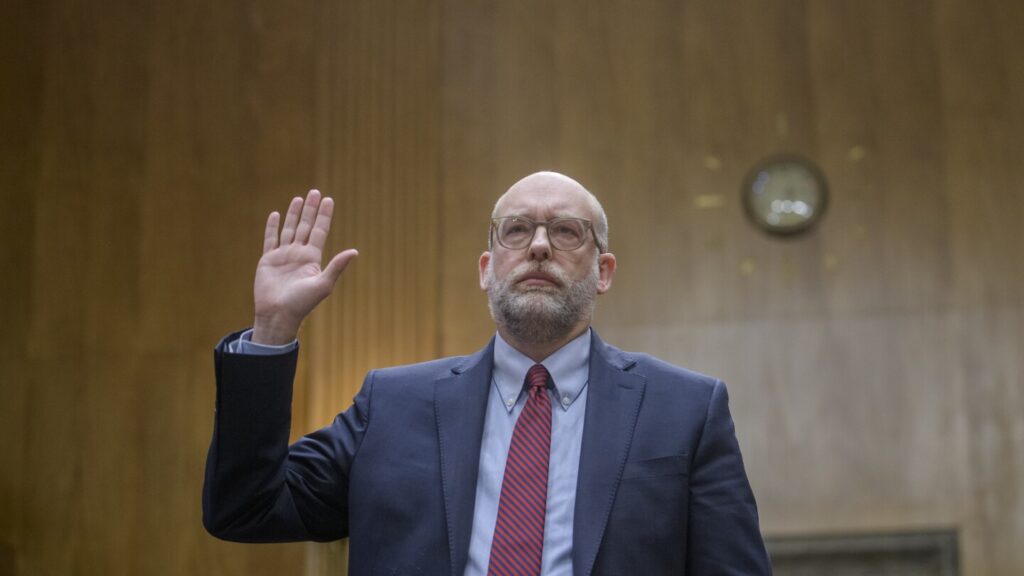

Russell Vert, Newly installed director Instructing the CFPB of the Administration and Budget Bureau, and in a Saturday night email confirmed by Associated Press, the proposed rules stopped working and valid dates of rules that have been finalized but not yet effective. They paused and instructed them to stop the investigation. Do not start a new investigation. The institution has been a target for conservatives ever since President Barack Obama pushed it to include it in the 2010 Financial Reform Act following the 2007-2008 financial crisis.

The email also ordered the department to “stop all supervision and exam activities.”

On Sunday, the CFPB headquarters in Washington, DC, will be closed from February 10th to February 14th, according to an email obtained by the Associated Press. There was no reason for the closure.

“Employees and contractors are supposed to work remotely unless otherwise indicated,” an email to headquarters workers said.

The order follows a similar effort by the White House. Dismantle it American International Development Agency.

As the CFPB is the creation of a Congress, another act of Congress would be required to formally remove it. However, the Chief of the Engineer has discretion as to which enforcement action should be taken, if any.

Still Elon Musk Comment “CFPB RIP” Friday on social media site X. And so was the CFPB homepage on the internet on sundayreplaced with the message “Page Not Found.”

Also late Saturday, Vought said in a social media post that the CFPB would not withdraw its next funding from the Federal Reserve, adding that the current $716.6 million was “excessive.” Congress directed the bureau to be funded by the Fed to isolate it from political pressure.

“This spigot, which has long contributed to the inexplainability of the CFPB, is now off,” Vought I said in x.

The CFPB says it has acquired nearly $2 billion in financial relief for U.S. consumers since it was founded in the form of cancelled debt, compensation and reduced loans. Last month, Sued Capital 1 As a result, of over $2 billion in profit losses, consumers are said to be misleading about offering high-profit savings accounts.

Dennis Kelleher, president of advocacy group Better Markets, said: Americans – Republicans and Democrats – fighting financial predators, con artists and con artists. ”

The administration’s move against the CFPB also underscores tensions between Trump’s more populist promise to reduce costs for working-class families and his pledge to reduce government regulations.

During the campaign, Trump will cap credit card rates at 10% after the Federal Reserve surged to average levels above 20% as interest rates increased in 2022 and 2023. He said. I had the CFPB. I’ve started work How the proposal will be implemented.

The bureau can still file complaints, but it cannot conduct exams or pursue existing investigations, according to anyone familiar with the institution that advocated anonymity to discuss the CFPB business. This memo is interpreted as blocking communications with regulated businesses, consumer advocates, or other external groups.

Musk’s teams also have access to complaints, investigations and regulatory surveillance data. Because CFPB has data on competitors such as the CASH app, access raises unpleasant questions if Musk’s Company X launches a payment system, the person said.

Vought’s email is the latest move by the Trump administration to quickly cut down federal agencies’ work they deemed excessive, following a similar directive from Treasury Secretary Scott Bessent on February 3.

Contact the Associated Press

The Associated Press is an independent global news organization specializing in virtually nonpartisan journalism. We report on changes within the US government under the new administration. If you are a former or current government worker who wants to share information with us, please send us a message about the signal on theap.1846

Obama led the creation of the bureau in the wake of the housing bubble and financial crisis of 2007-2008. It was the brainchild of Massachusetts Democratic Sen. Elizabeth Warren and attracted it. Litigation From industry associations in the large banks and financial industry.

“Vought is about giving big banks and giant businesses a green light to scam families,” Warren said.

Last week, Warren called on Trump to work with the Bureau to prevent Americans from banking. It is a practice for banks to close customer accounts because they believe they pose financial, legal or reputational risks to them.

“We know that the Consumer Financial Protection Bureau is the Republican favorite whipping boy on this committee, but the CFPB is a major institution in our government and is proactive in stopping unfair withdrawal. “We’re working on it,” she said at a Senate hearing. Banking, Housing and Urban Affairs Committee.

Vought’s email said President Donald Trump made him the acting director of the CFPB on Friday. Trump Dismissal On February 1, the former director of the Bureau, Rohit Chopra, was the architect of Project 2025, the Trump White House policy blueprint that Trump tried to deny during last year’s campaign.

Under the chop, the CFPB has approved rules that limit overdraft fees by banks, restrict junk fees, and suggests limits to data brokers who sell personal information such as social security numbers.

___

Associated writers Josh Boak and Chris Megerian contributed to this report. Associated Press writer Holly Lamar was a contribution from Concord, New Hampshire.