Encounter with Ferrari (New York Stock Exchange: Race) The latest supercar, F80. Given Ferrari’s notorious exclusivity in vehicle sales, the car may be nearly impossible to get your hands on, but it’s likely to help drive the automaker’s future profits. And if you can’t buy a Ferrari F80, buying shares might be your next best option.

Here’s why:

Start your morning smarter! Wake up with breakfast news delivered to your inbox every market day. Sign up for free »

Ferrari F80. Image source: Ferrari.

Ferrari makes a profit

No matter how you look at it, the F80 packs a punch. With Ferrari’s signature sharp red paint, a top speed of nearly 320 miles per hour, and an engine built from technology derived from the company’s F1 efforts, this is an incredible supercar.

Another amazing thing about the F80 should be music to investors’ ears. Its price starts at a whopping $3.9 million before options. Ferrari announced the F80 in October and has already sold out all order books for the 799 cars originally planned for sale.

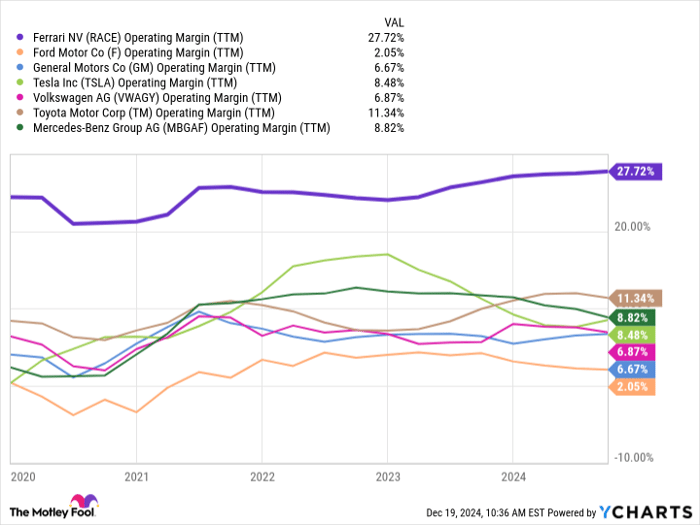

Remember that Ferrari keeps a lid on sales numbers to preserve pricing power and brand exclusivity. It’s this pricing power that helps the company maintain favorable margins compared to standard automakers.

Data by YCharts.

As you can see, Ferrari has a history of crushing its competitors when it comes to margins. The good news for investors is that F80 has the potential to further improve profit margins. Anthony Dick, head of the automotive sector at Paris-based private bank ODDO BHF, told Barron’s that the F80’s profit margins could be very lucrative, generating 2% of sales but 20% of Ferrari’s profits. He said it was possible. The F80 is not expected to start shipping until late 2025, but analysts expect Ferrari earnings per share to rise 10% to $9.35 in 2025.

Is Ferrari stock worth buying?

Many automakers are currently struggling overseas, both in China and Europe. Ford Motor Co. announced in November that it would cut its European workforce by 4,000 people by the end of 2027 and restructure its business to create a more cost-competitive structure. General Motors has seen its sales in China slump from a peak of 4 million vehicles in 2017 to about half by 2024 and needs $5 billion to rebuild its struggling business. It becomes necessary.

Fortunately for investors, Ferrari doesn’t have a China problem. In fact, it is one of the company’s smallest regions. Shipments from China, Hong Kong and Taiwan accounted for just 8% in the third quarter, down slightly from 11% a year ago. This means that Ferrari can now escape headwinds in this country and have the opportunity to grow in the region in the future.

Investors who were worried that Ferrari’s focus on internal combustion engine (ICE) supercars would leave it behind competitors as the world moves to electric cars need not worry. In fact, you might be surprised to learn that 55% of Ferrari’s deliveries in the third quarter were hybrids and 45% were ICEs. Additionally, the iconic automaker plans to launch its first fully electric vehicle in the second half of 2025 with a price tag of at least $535,000, according to Reuters.

Ferrari is an incredibly unique car manufacturer that trades at a premium thanks to its brand strength, pricing power, and racing ability. The company currently trades at a price-to-earnings ratio of 52 times, which means it rarely trades at a discount, especially compared to its auto industry peers. Until the recent decline in its stock price, Ferrari had nearly tripled the S&P 500 index’s returns over the past three years. If you’re looking for a solid stock that drives growth, F80 could help boost the company’s earnings sooner rather than later. Ferrari remains my favorite car stock. Or maybe it’s time to call Ferrari a luxury superstar.

Should you invest $1,000 in a Ferrari right now?

Before buying Ferrari stock, consider the following:

The Motley Fool Stock Advisor team of analysts identified the 10 best stocks for investors to buy right now…and Ferrari wasn’t one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $825,513.!*

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor returns as of December 16, 2024

Daniel Miller has held positions at Ford Motor Company and General Motors. The Motley Fool has a position in and recommends Tesla. The Motley Fool recommends General Motors and Volkswagen Ag and recommends the following options: Long-term January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.