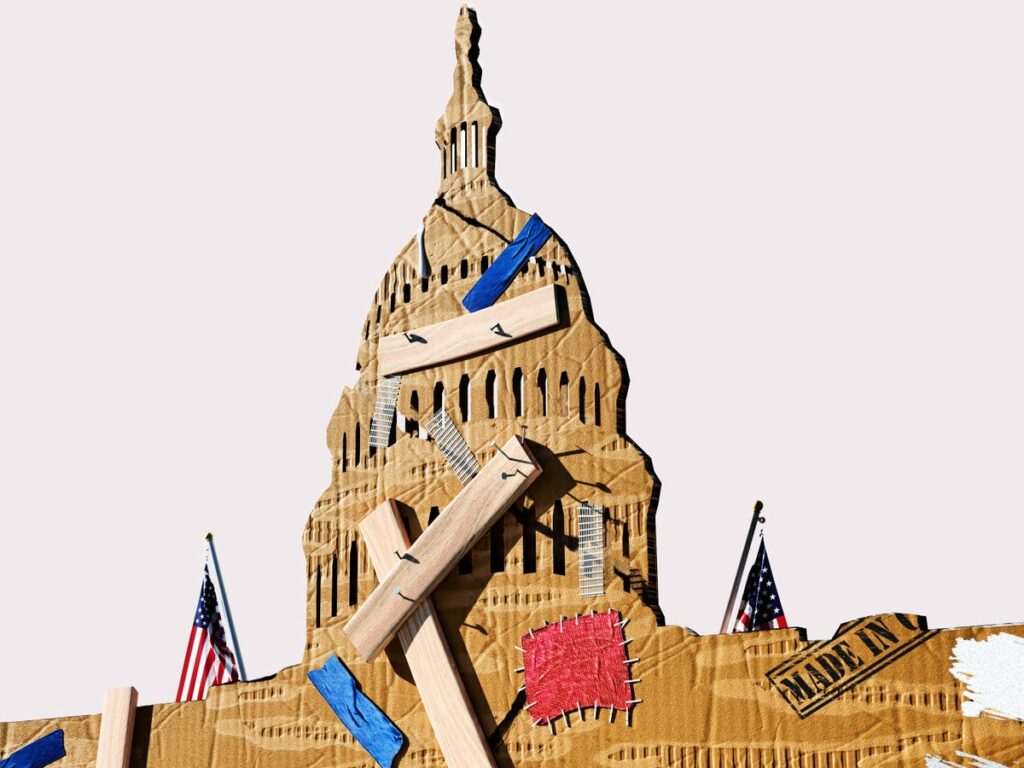

The negative side risks to the US economy are upset. The job market is not as innocent as it once was. The proportion of people hired or resigned remains under where they stood before the pandemic, but layoffs are clicking at margins. Beyond that, growth has narrowed and the housing market has stagnated. Washington’s changing political climate also adds uncertainty to the outlook. This all brings a lower outlook for 2025, even if many economists and analysts are reluctant to acknowledge it.

To prevent the economy from degradation, the Federal Reserve is forced to ease policy easing by cutting interest rates more aggressively than members and investors currently expect. Based on the odds estimated from the market, investors are hoping to see two cuts from the Fed in 2025. But as the true picture of the economy appears in our field of view, I will expect more than that before the year comes.

After years of warning that the crash had turned the corner, economists and Wall Street analysts abandoned the idea that the idea of a recession and a slowdown in meaningful growth has largely hit the US. However, the core part of the engine is slowing down and the Fed sits and does nothing, so the chances of a significantly weaker economy are increasing.

A reasonable reading of data refers to a clear cooling of the US economy. Certainly, GDP growth in 2024 reached a respectable 2.5%, but that was down from 3% in 2023. And the way the US reached its growth was not particularly encouraging. Household consumption and government investments accounted for a large part of last year’s growth, but total private domestic investment, where businesses put money into businesses and track the amount spent building new homes, apartments and other structures, was a modest drug. Given the narrow structure of growth, there is a reason that if consumer spending and government investment are moderately eased, the economy will also ease. The slowing cases in both categories are strong.

Consumption outlook is summarised in income. People can only spend more money when more money comes. And it is clear that revenue growth is easing as the labor market cools down. The proportion of people leaving their jobs will hit a fresh low at the end of 2024, and as they quit, wage growth will also decrease. This makes sense. If workers are less likely to quit their job, employers are less likely to need to receive a salary increase to change their strength from employees to employers. And so does consumption as income slows down. In fact, we have already seen some of this decline. Inflation-adjusted income, a net of transfer payments – pay agents for people with government payments like Social Security and Medicaid were the perfect point below the pace of consumption. At the same time, the personal savings rate (a measure of the percentage people are putting aside) in 2023 fell from 4.4% to 3.8%, suggesting that Americans were immersed in reserves to continue spending. However, there is a limit to how much consumers can reduce their savings to fuel purchases.

Another pillar of our growth, government spending, also shows signs of tension. And it’s not just from the Doge Cut, defended by Elon Musk. The state has received a significant cash increase during the pandemic era, but these surpluses are rapidly declining. State and local government construction spending in 2024 rose 4.4% from 19.7% in 2023. Employment by state and local governments is also declining. A recent report from Pew states, “The state budget is expected to shrink significantly in fiscal 2025. The post-pandemic era of revenue, record spending and historical tax cuts is over. According to new data released by the National Association of Budget Officials (NASBO), the general fund total spending is expected to decrease at a maximum level of $1.22 from 1.22 Trillion, June 30th.”

Even spending on new housing, one of last year’s GDP components, is set to be worse in 2025. With slower incomes, interest rates continue to rise, causing affordability issues, making it difficult for people to buy homes, and allowing sellers to put upward pressure on the number of homes sitting in the market longer for them to find buyers. Redfin recently said, “The increase in new lists with slow sales has contributed to an increase in the supply pool that home buyers can choose from. Also, the biggest discount in two years, the typical home sold at the asking price at 2%.”

This slowdown in growth will have serious consequences for Americans. One clear drawback is that there is a high chance that the number of people leaving work will increase. Despite the strong growth in both 2023 and 2024, unemployment still rose by 0.3 percentage points for each of the year. If growth is likely to slow down in 2025, it is not a difficult leap to assume that unemployment will continue to rise. If there is more slack in the job market, it’s not hard to see incomes slower and negative feedback loops kick in and weigh household spending and other parts of the economy.

Related Stories

Of course, there are ways to slow or avoid the worst effects of this slowdown. One of the most important routes to help the economy is for the Fed to cut interest rates. Lower debt will encourage businesses to invest or hire, while also providing some cushions to their household balance sheets.

After all, the Fed had already reduced key rates late last year to reach a deeper slowdown in the labor market. And the reason the Fed hiked inflation in the first place shows continued signs of progress towards the central bank’s 2% year-on-year growth target. The latest consumer price index inflation reading was a little higher than expected, but the Fed’s preferred personal consumption expenditure inflation gauge gave us better news. Core PCE inflation has a much larger range than CORE CPI, making it more reliable and returned to orbit in November and December after two months of disappointment. Compared to the Fed’s target, most of the lack of core inflation is housing. Given the aforementioned slowdown in price growth in the housing market, it makes sense that this will continue to be mitigated.

But instead of maintaining rate reductions, the Fed prefers to change courses and prefer a more responsive approach to data on accidental inflation. It’s already stupid to wait for permission from the data before moving rates, as you increase your chances of falling behind, but the reason for the Fed’s concern about increased inflation is not clear that this all comes down to speculation about what the new administration will do, so it doesn’t make any sense.

Shortly after the election, Fed Chairman Jerome Powell was pretty clear when asked about the policies of the next administration. “We don’t guess, we don’t assume, we don’t assume,” Powell told reporters. A month later, it seemed Powell had changed his song.

“Some people have taken a very preliminary step and have begun to incorporate highly conditional estimates of the economic impact of policy into forecasts at this conference, and have said so at the conference,” he said at a press conference following the Federal Reserve’s December meeting. In other words, they guess, guess, assume. How convenient!

Talk to the elephant in the room: Donald Trump. Over the past few weeks, many business economists have highlighted the uncertainty that comes from his administration, citing his confused approach to trade policy. Unaddressed tariff threats are said to freeze business investments and can raise inflation if implemented. I think this is the source of Powell’s waiting pivot. However, evidence of real effectiveness from the president’s policies has so far been weak.

When power changes hands in Washington, there is always uncertainty. Consider alternatives. There are even more questions about whether Kamala Harris won the election, or whether the 2017 tax cut, which expires at the end of the year, will be extended, or whether tax rates for households and businesses will rise. If corporate taxes rise at the end of the year, broad research suggests that these tax increases are likely to be passed on to consumers. Does anyone seriously consider the Fed worried about the benefits of inflation from corporate tax pass-through? No, the Fed may be focusing on interest rate reductions as a way to stem the negative growth risks from declining spending and investments. This is why preventing consequences is so irresponsible. Follow the data rather than guessing about a set of policies that may not take effect.

Related Stories

To me, it is clear that companies are willing to give the new administration the benefits of doubt. Tariffs are not the only dimension of policy. Perhaps companies are willing to tolerate short-term uncertainty regarding tariffs when it implies future regulations and improved tax context. Clearly, there is enthusiasm for, for example, a light touch approach to financial regulations.

Trump is not the only source of uncertainty either. If Congress shakes the ball with law, confidence can stall, especially when confidence is cuts and employment laws are extended at the end of the year. That would be a much greater risk to the economic outlook than the threat of tariffs. The downside scenario here is clear. Although not immediately from either Congress or Trump, the Fed decides to hold back something as nominal growth continues to slow down as it is concerned about possible policies. This is a passive tightening of monetary policy and has important implications for financial market investors. As risk appetite declines, long-term interest rates and stock sales are expected. For the economy, expect conditions to deteriorate in the job market.

The Fed will ultimately cut interest rates to support growth, but there is a way that usually comes up if you are waiting for bad news to come out before doing anything.

Neil Dutta is head of economics for Renaissance macro research.