The Dow Jones Industrial Average suffered its worst losing streak in more than 40 years as investors’ expectations that the Federal Reserve would cut interest rates aggressively next year continued to decline.

Central bank officials conclude their final two-day meeting of the year on Wednesday, when they are widely expected to announce another quarter-point rate cut, the third this year.

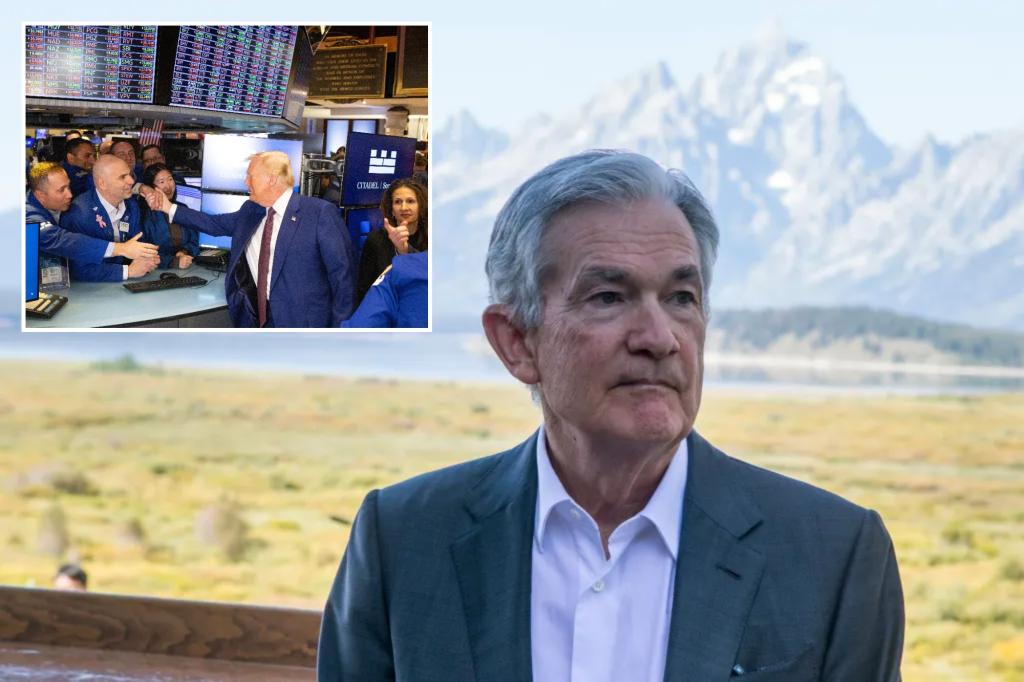

But the Fed’s Summary Economic Outlook (SEP) and Chairman Jerome Powell’s comments will be of particular interest, and could indicate how aggressively the Fed will cut rates in 2025.

With the economy showing solid momentum and persistent inflation, and expectations that the incoming Trump administration will introduce policies to stimulate growth and reignite price increases, the Fed could slow its pace of easing.

“This is like standard fare in the pre-Fed day market where there’s just a little bit of uncertainty, and people are wondering how ahead of SEP and ahead of Powell,” Chief Investment Officer Jason Ware said. I don’t know if I should take the position.” Albion Financial Group, Salt Lake City, Utah;

“Everyone knows we’re going to be at 25 bps…what Mr. Powell is going to say in his press conference, what the SEP is going to tell us, people are very sure of those things. I haven’t, so I’m going to be a little nervous before that happens.”

On Tuesday, the blue-chip Dow Jones Industrial Average fell 267.58 points to 43,449.90, extending its longest losing streak since 1978. The S&P 500 fell 0.39% to close at 6,050.61, and the Nasdaq Composite Index, which hit a record high on Monday, was down 32%. Ends on 20,109.06.

Part of the Dow’s decline can be attributed to profit-taking just after the 30-stock index hit a record high of 45,000.

A CNBC survey of 27 top economic experts found that 93% expect a quarter-point rate cut in December from the current range of 4.50% to 4.75%.

But even though experts say President Trump’s initial jab revived economic activity on Main Street and Wall Street, only 63 of those surveyed said that was the right thing to do. It was %.

Inflation is 2.7%, well above the Fed’s 2% target.

Policymakers are expected to continue lowering interest rates over the next two years. The policy rate is expected to be cut to 3.8% by this time next year, and to 3.4% by the end of 2026, just above the average neutral rate, according to a CNBC poll.

But the survey of economists, strategists and fund managers showed that they remain concerned about President Trump’s threats to impose tariffs and tax cuts on foreign goods.

Economist Robert Frey said, “I don’t remember ever being so uncertain about the outlook for inflation,” adding, “A mix of inflationary policies (tariffs, personal tax cuts) and disinflationary policies (deregulation, spending cuts) are likely to result. “There is,” he warned.

“Nobody knows what the final combination will be,” he added.

According to a CNBC poll, 56% of experts surveyed say the incoming administration’s economic fundamentals are “somewhat inflationary,” and a further 11% see them as “extremely inflationary.” There is.

Economist Joel Naroff said: “The economy remains surprisingly strong, and the only immediate risks are potential tariffs and possible deportation of essential and irreplaceable immigrant workers.” “This is stemming from the crisis,” he added, referring to the president-elect’s campaign promise to solve all problems. Immigrants who entered the country illegally at the southern border.

Wednesday’s Jackson Hole rate cut could lower borrowing costs for American households and businesses, allowing investors to pour more money into the stock market.

CNBC survey respondents also pointed to Uncle Sam’s $1.9 trillion fiscal year 2024 budget deficit as a potential red flag that could push prices higher.

A budget deficit occurs when the government spends more money than it receives in a given period of time.

This can lead to inflation, especially if money is printed by central banks to plug fiscal black holes.

Estimates released on October 28th by the Committee for a Responsible Federal Budget, a budget think tank, show that President Trump’s proposed policies could reduce the U.S. fiscal debt from its current $36 trillion peak to $7.75 trillion over the next 10 years. It turns out that there is a potential for an increase of $1 billion.