Key takeout

Super Micro Computer (SMCI) stocks surged on Tuesday, forecasting significant sales growth in 2026 in response to demand for artificial intelligence servers, making them increasing pace to extend their profit streak Masu.

The company’s shares jumped over 10% on Tuesday. This will be the fourth straight trading day of growth since the second quarter business update of Super Miro on February 11th (President’s Day closes the market on Monday). All in all, since the update, stocks have risen by around 40%.

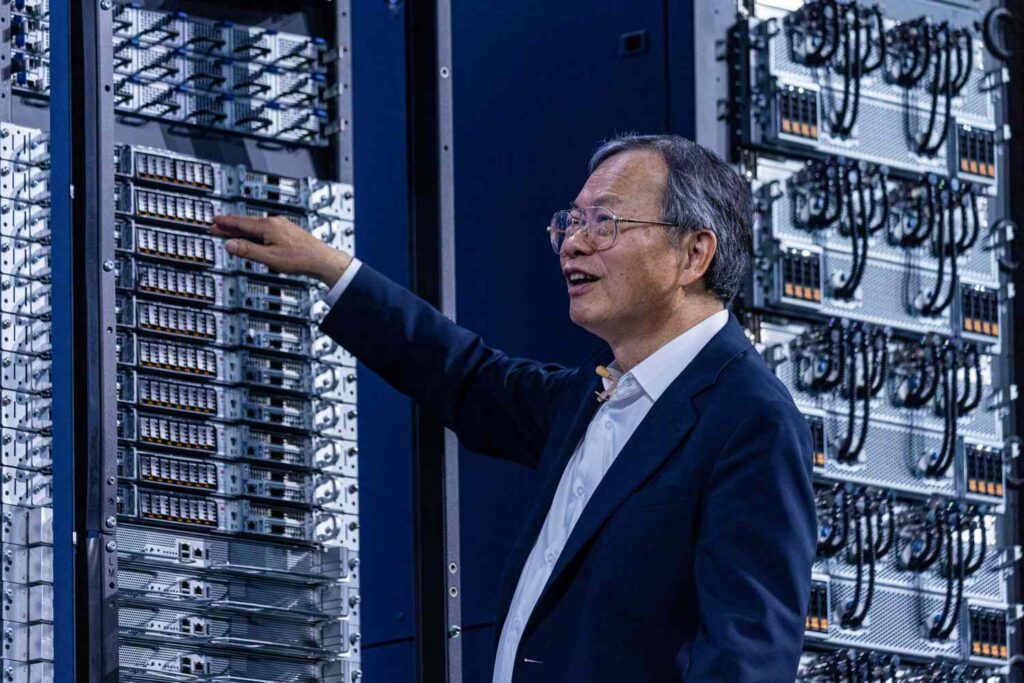

Supermicro CEO Charles Liang called for $40 billion in 2026 to earn 60% more revenue in 2025 than expected.

Last week, a JPMorgan analyst said that 2026 estimates “present a great upside” is also referred to as the “offensive” target. Analysts maintained the “underweight” rating of the stock, but raised their price target from $23 to $35.

As part of last week’s renewal, Supermicro said it expects to file a delayed financial report from fiscal year 2024 by the February 25 deadline for NASDAQ to avoid registration. Notably, despite the week of growth, Super Micro stocks have fallen by about a third over the past 12 months, partly due to concerns about the company’s accounting practices.