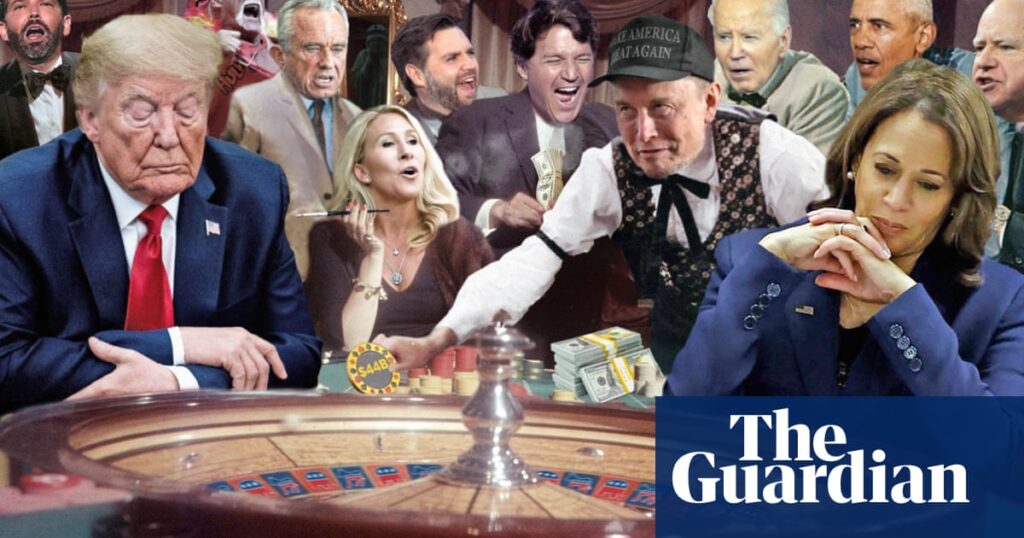

MOst gamblers may wish to stay out of US elections. According to official polls, Kamala Harris and Donald Trump are too close to even. But the former president’s camp sees signs that prove he is indeed “in charge.”

In a close race, Mr. Trump and his allies claim, as he said last week, that he has a significant lead over Ms. Harris in several “gambling polls.” “Around 65 to 35 years old, I guess.”

The irony of touting a clear lead in the gambling market at a Georgia Believers and Vote campaign event aimed at Christian voters was not lost on President Trump. “But no one gambles here,” he continued. “Does anyone here gamble? No, no, no, no. Great Christians don’t gamble, right? Oh my god.”

The “gambling poll” cited by President Trump is a projection generated by several election betting platforms that puts President Trump’s chances of returning to the White House significantly ahead of his Democratic rivals. While many question the accuracy of political polls, advocates, including Elon Musk, have begun to argue that such estimates are more accurate.

As of Wednesday, leading service provider Polymarket predicted that Mr. Trump’s chances of regaining the presidency were about 67%, while Ms. Harris’s chances were 33%. Another, Mr. Carsi, gave Mr. Trump 62% and Ms. Harris 38%.

And while Mr. Trump’s audience last Tuesday wasn’t interested in betting on the outcome of the presidential election, many others appear to be in on it, too. The effort has gained attention as the campaign gains momentum, with high-profile legal battles, propaganda from Musk, Trump and others, and increased media coverage.

Thomas Gluka, a marketing professor at the University of Iowa and director of Iowa Electronic Markets, an election-focused futures market founded in 1988, said the interest in betting on elections this time around has increased compared to previous years. It is said to be “an order of magnitude larger” than voting.

The U.S. gambling boom, driven by the legalization of sports betting, has “increased the number of people who want to throw away their money on something they don’t understand,” Gruka said. “People think, ‘I picked the Raiders-Jets game, so I can choose the president.'”

He also pointed to polling errors from the last election and the number of polls that suggest this race is extremely close. “I haven’t looked at the polls in the last 15 minutes, so I don’t know who won. The previous years have been very clear.”

In the magazines and newspapers section of Apple’s iPhone store, Polymarket took the top spot, beating out the New York Times, Wall Street Journal, and, of course, the Guardian. Another platform, Kalshi, is similarly climbing the charts of financial app stores.

“I don’t think it’s a coincidence that these markets are becoming more popular at a time when trust in the media is declining,” said Harry Crane, a statistics professor at Rutgers University. “The public wants information and they are looking for reliable sources.”

For example, if you turned to the polymarket and bet on Trump on Wednesday, you would receive $1 for every 67 cents you bet if Trump wins the election. If you bet on Harris on the same day and on the same platform, you would receive $1 for every 33 cents you wagered if she won.

These bets are bids on political futures contracts. When you purchase a contract, you increase its price or the probability that the contract will occur.

This ecosystem goes far beyond the White House fight. Other markets for Kalsi include the margin of victory in the Senate, which states are closest to the presidential election results, and what the Federal Reserve will do about interest rates two days after the election.

But how reliable are the headline numbers? “I think we should take them seriously,” said Grant Ferguson, a political scientist at Texas Christian University. “People betting on these markets often think they know more than the average person about how things are going.”

Ferguson said Hillary Clinton was leading on Election Day in 2016 (she won the popular vote, if not the presidential election) and Joe Biden was leading in 2020. , in both cases the margins were smaller than the polls showed,” Ferguson said. 2024 will be the biggest test for these predictions so far.

“In general, these markets are actually very efficient, especially in the 50:50, 60:40 space,” said Eric Zitzewitz, an economics professor at Dartmouth College. Ta. “In the situation we’re in right now…I take it pretty seriously.”

If a market “operates efficiently or according to good rules, prices before an event occur will reflect what intelligent people are thinking, not just random people,” Gluka suggested. did.

The Iowa Electronic Market allows participants to bet up to $500 on a particular contract, while PredictIt, run by Victoria University in Wellington, New Zealand, has a limit of $850. . But other platforms have less stringent restrictions, and larger bets may have swung the odds in Trump’s favor.

Polymarket did not respond to requests for an interview, but last week it confirmed that a French national was behind four accounts that placed about $28 million worth of bets on Mr. Trump, according to The New York Times. He claimed to the paper that it was “based on…” This is my personal opinion, not an attempt to manipulate the market.

“Without restrictions, prices can move further away from where they should be,” Gourka said.

Ferguson suggested that if one person tried to tilt the odds towards their favored candidate, bettors would quickly back the other side if the odds fell too low. “Would that possibly happen? Yeah,” he said. “But I’m not really worried about that.”

There are small but significant differences in the questions that are central to election research and election betting. While poll respondents say which candidate they want to win, people betting on elections say who they think will win. Veterans in the field often say that poll participants focus on their hearts and bettors use their heads.

Gambling markets are “asking better questions,” Crane argued. “Poll information is in the market. People in the market know what polls are, but they also have other information.”

Regulators are not satisfied. The Commodity Futures Trading Commission, which fined Polymarket $1.4 million in 2022 and ordered it to remove its U.S. users as part of a settlement, is attempting to shut down PredictIt and Calci.

But recently, a federal appeals court ruled that the CFTC failed to show how the agency or the public interest was harmed by the event contract, allowing Mr. Carsi to participate in U.S. bets on election results. It was done.

The CFTC is attractive, but this legal breakthrough appears to set the stage for even more bets by both individuals and large organizations about who will win the presidential race. Polymarket is also scrutinizing activity on its platform to ensure users are located outside the United States amid reports of domestic use.

“The market is only as smart as the people trading in it,” Gurka says. “If you’re stupid as a rock and have a lot of money, you can move the market in the direction you want by just moving your money.”