Nvidia (NVDA) was on a roller coaster ride in early 2025, and despite impressive financial results, its stock is facing sharp selling. In the fourth quarter, the company saw a 78% increase in revenue and an 80% increase in profits compared to the previous year. However, lower margins, changing market dynamics and concerns over regulatory challenges have kept investors ahead.

If you want to read more about Nvidia, I recommend that analysts at Tipranks Analyst Bernard Zambonin, have had to say here about NVDA stocks.

It’s strong growth, but it’s a sacrifice

Nvidia’s fourth quarter revenue reached $39.3 billion, surpassing its $37.5 billion forecast. The company’s data center segment has driven much of this surge, bringing it to $35.6 billion, an increase of 93% from the previous year. Nvidia’s latest Blackwell technology played a major role in this expansion, generating $11 billion in revenue as AI companies rushed to secure the latest chips. Meanwhile, the previous generation of Hopper 200 continued to see strong demand as companies upgraded their outdated infrastructure to keep up with AI advances.

Despite these impressive numbers, Nvidia’s gross profit fell from 75% to 70%. The company was attributing this to the rapid production ramp-up of Blackwell Chips, which required additional costs to meet the rising demand. Nvidia hopes margins will recover in the second half of 2025, but the decline has sparked concerns about whether supply chain pressures could affect profitability in the long term.

Competition and external challenges

Beyond internal pressure, Nvidia faces an increasing number of external challenges. New competitors such as China’s Deepshake are emerging in the AI semiconductor space, potentially moving demand away from Nvidia. Additionally, US government tariffs and export restrictions could limit the ability of NVIDIA to sell high-end chips in major markets, including China. These regulatory hurdles can affect revenue and profitability, adding uncertainty to Nvidia’s growth trajectory.

Evaluation and future outlook

There has been a P/E ratio of 42.5 times over the last 12 months, with 27.7 times forecast for 2025, and Nvidia remains a high-growth stock. However, the roads in front may not be as smooth as before, as margins are increasing pressure and competition. NVIDIA continues to lead AI GPU technology, but it needs to change market trends, regulatory developments, and supply chain challenges.

What are the predictions for NVDA stocks?

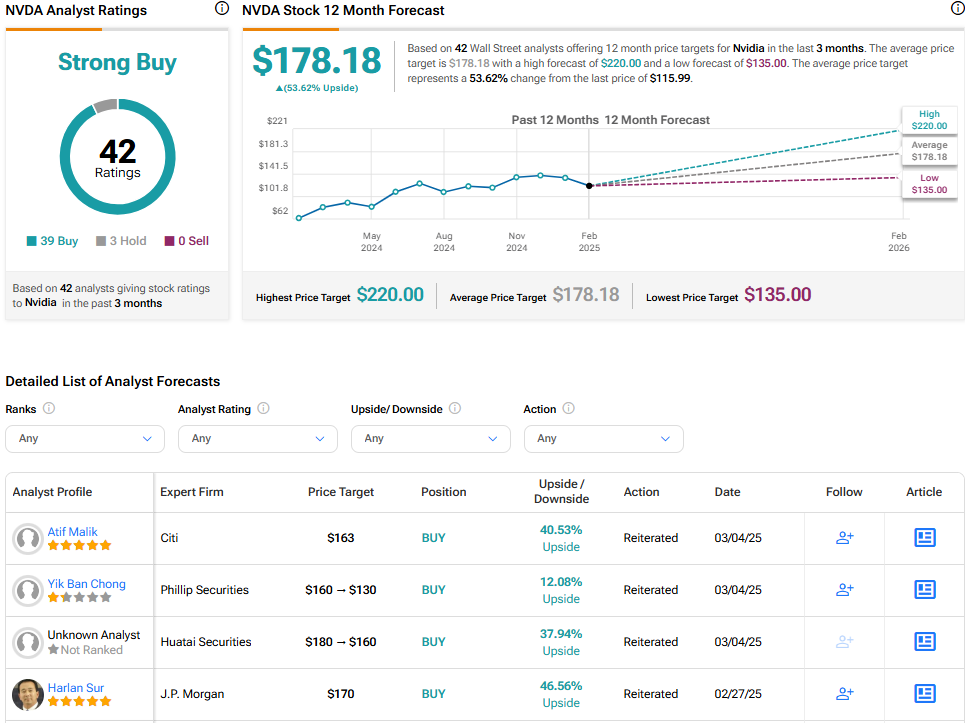

Turning to Wall Street, Nvidia is considered a strong purchase based on ratings from 42 analysts. The average price target for NVDA stocks is $178.18, suggesting a 53.62% upside potential.

See more NVDA Analyst ratings