Kroger’s chairman and chief executive Rodney McMullen resigned after an internal investigation into his personal actions.

Kroger, the country’s largest grocery chain, said Monday that investigations of McMullen’s personal conduct have been found to be unrelated to business but contradict its business ethics policies.

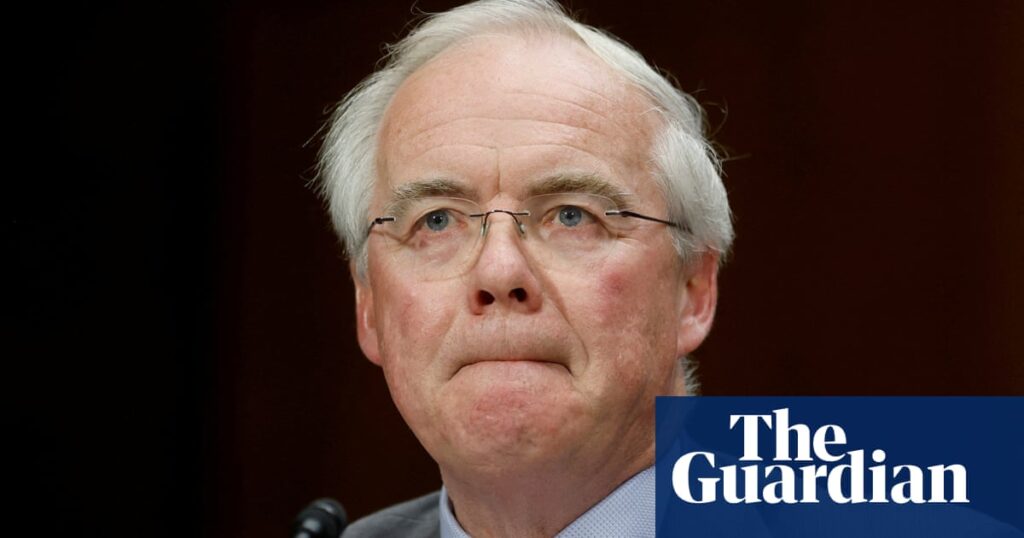

Board member Ronald Sargent will serve as chair and interim CEO and will soon be enforced.

Sargent has been on the Kroger board of directors since 2006 and has been the company’s lead director since 2017. He has played several roles in grocery chains across stores, sales, marketing, manufacturing and strategy. Sgt. is also former chairman and CEO of Staples.

McMullen, 64, began his career at Kroger in 1978 as a part-time stock clerk and bagger at a store in Lexington, Kentucky. He went his own way through the company, becoming Chief Financial Officer in 1995 and Chief Financial Officer in 2009. McMullen was appointed CEO of Kroger in 2014 and became the company’s chairman the following year.

Cincinnati-based Kroger said the board would recognize the situation on February 21 and would soon hire an outside independent counsel and carry out an investigation overseen by the Special Committee Committee.

The company said McMullen’s actions were not related to financial performance, operations or reporting, and Kroger Associates was not involved.

Kroger does the next CEO search and Sargent agrees to remain as interim CEO until someone is permanently appointed to the role.

Kroger’s shares fell more than 3.5% from the opening bell on Monday.

McMullen’s departure is because Kroger is reorganised from his failed efforts to fuse with the Albertsons. The companies proposed what was the biggest supermarket merger in US history in 2022, saying the strength needs to be combined to compete better with rivals such as Walmart.

However, two judges said they were likely to halt the $24.6 billion deal in December, reducing competition and increasing prices. The Albertsons later sued Kroger, saying they were unable to make any effort to ensure the merger would win regulatory approval.