(Bloomberg) — Confidence among Japan’s big companies turned out to be slightly more bullish than expected, keeping the Bank of Japan on track to consider raising interest rates later this year or early next year.

Most Read Articles on Bloomberg

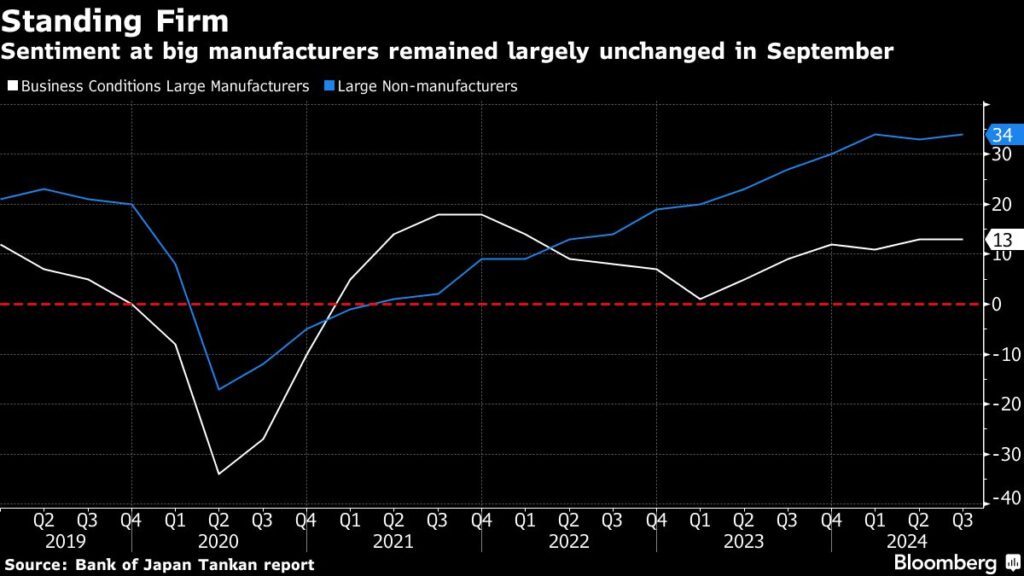

According to the Bank of Japan’s quarterly Tankan report on Tuesday, the sentiment index for Japan’s largest manufacturing industry was flat at 13 in September. The index for the largest non-manufacturing industry rose to 34. Economists had expected manufacturing to fall to 12 and services to fall to 32.

Looking at the numbers for both groups, we see that optimists outnumber pessimists.

The Tankan survey is one of the key data points released before Bank of Japan board members next decide on policy on October 31. Although the Bank of Japan’s policy is expected to remain unchanged due to factors such as the elections in Japan and the US, the continued strength of these statistics may prompt economists to make a decision. The meeting’s risk scenario will consider raising interest rates.

Atsushi Takeda, chief economist at Itochu Research Institute, said, “Today’s Tankan confirmed a recovery in demand, marking the start of a virtuous cycle.” “Businesses are maintaining their price outlook, indicating that there are currently no obstacles to the Bank of Japan’s rate hike.”

Companies across sectors and sizes kept their inflation outlook unchanged, according to Tuesday’s report. A majority of economists expect the bank to raise borrowing costs by the end of January, and 15% expect it to do so in October, according to the latest Bloomberg survey.

The Tankan data also showed that in the manufacturing industry, business confidence improved for electronic equipment, ship and heavy equipment manufacturers, while business confidence for oil and coal product manufacturers weakened.

The continued optimism among manufacturers may have been helped by a recovery in the semiconductor demand cycle. Japan’s technology sector is benefiting from a wave of global demand for artificial intelligence development, which is creating high demand for advanced semiconductors and related machinery. Exports of the country’s chip manufacturing equipment rose 55% in August from a year earlier, according to data so far.

Sentiment among service sector companies also unexpectedly improved slightly, led by retailers and construction companies, supported by the hospitality sector. The Japan National Tourism Organization announced in a release last month that the number of foreign tourists visiting Japan in August reached 2.93 million, an increase of 16.4% from the same month in 2019 before the pandemic.

story continues

Bloomberg Economics speaks…

“Signs from the BOJ Tankan survey, with surprisingly strong business confidence, particularly in the services sector, and expectations that inflation is likely to remain above the 2% target, suggest that the economy is poised for the BOJ to further ease stimulus. This suggests that it is possible.”

— Taro Kimura, economist

Click here to read the full report

Strong business confidence is likely to be welcomed by Prime Minister-elect Shigeru Ishiba, who won an overwhelming victory in last week’s Liberal Democratic Party leadership vote and is expected to be elected prime minister late Tuesday. Ishiba announced that a national election will be held on October 27th.

A separate report released by the Labor Ministry on Tuesday showed Japan’s job market remained tight in August. The country’s unemployment rate fell to 2.5% from 2.7% last month, and the job openings-to-applicants ratio fell slightly from 1.24 to 1.23. In other words, there were 123 job openings for every 100 applicants.

A tight labor market continues to keep upward pressure on wages as companies compete to retain employees and attract new hires. Companies and unions will soon lay the groundwork for next year’s wage negotiations.

–With assistance from Paul Jackson.

(Updated with economist’s comment. See report for details.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP