It’s hard to be the king of AI.

Nvidia signaled that demand for AI remains strong, more than doubling its revenue from the same period last year and forecasting revenue of $32.5 billion in the next quarter.

But that didn’t come as a surprise to industry experts on Wednesday.

The multi-trillion-dollar company had been widely expected to report strong quarterly results as big tech companies continue to pour billions of dollars into artificial intelligence, locking in demand for Nvidia’s prized chips.

But working against Nvidia are the sky-high expectations that investors have always placed on the Silicon Valley chipmaker, analysts and industry experts told Business Insider, especially as they worry about the returns on their AI investments.

“The numbers are great,” eMarketer analyst Jacob Born told Business Insider. “The problem is that investors continue to raise their expectations for Nvidia quarter after quarter, and those expectations are becoming unrealistic.”

Emarketer is a subsidiary of Axel Springer, which also owns Business Insider.

Similarly, Daniel Neumann, CEO of tech research firm Futurum Group, told BI that while Nvidia’s second-quarter numbers were strong, “that level of strength was already priced in by investors.”

By any standard measure, Nvidia performed better than well this quarter.

The company reported revenue of $30.04 billion for the quarter, more than double the figure from the same period last year and beating analyst expectations of $28.86 billion.

Still, these numbers drew a lukewarm response on Wall Street.

What Neumann described as the “almost irrational mania” around Nvidia is reflected in the company’s stock price, which was down 6.9% after the close of trading on Wednesday as of press time.

According to Bloomberg, “The options market is predicting that Nvidia’s shares will surge nearly 10% in either direction in the session following its earnings release.”

Questions also emerged ahead of Wednesday’s earnings report over concerns surrounding delayed shipments of the company’s Blackwell GPUs, which are expected to replace Nvidia’s Hopper.

“Recent delays in Blackwell’s market release schedule have increased investor anxiety,” Born told BI.

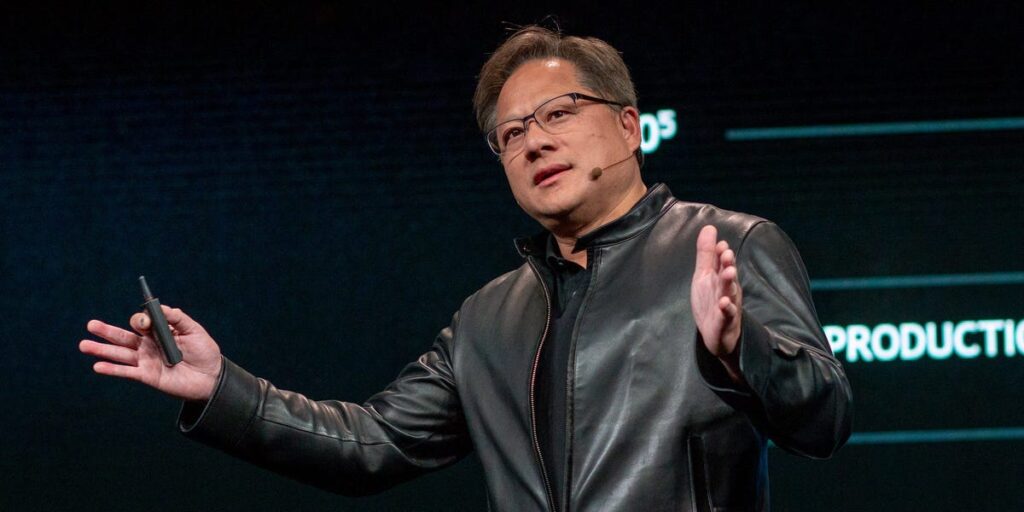

During an earnings call on Wednesday, Nvidia CEO Jensen Huang promised that the company would ship billions of dollars’ worth of Blackwell GPUs by the fourth quarter, but analysts warned that the metric was vague. Despite follow-up questions from investors, Nvidia executives on the call remained vague about the profits the company expected from Blackwell.

“Blackwell making billions of dollars this year is a pretty big number,” Grace Harmon, connectivity and technology analyst at eMarketer, told BI.

Overall, experts say Nvidia has largely allayed concerns about Blackwell’s shipping delays, but whether shipments are delayed is crucial for the company.

“It will be difficult for the company to deliver a significant beat on expectations, but the launch of Blackwell’s new chips later this year should give the company a boost,” wrote Logan Park, a technology analyst at Edward Jones.

While inflated expectations could work against Nvidia, Huang continued to set lofty goals for the company’s near future.

“Next year is going to be a great year. We expect the data center business to grow significantly,” Huang said on the conference call. “Next year, Blackwell will be a complete game changer for the industry, and Blackwell will continue its momentum in the coming year.”

Emma Cosgrove contributed to this report.