(Bloomberg) – Deepseek’s breakthrough in artificial intelligence has helped to drive stock fund rotation from India back to China.

Most of them read from Bloomberg

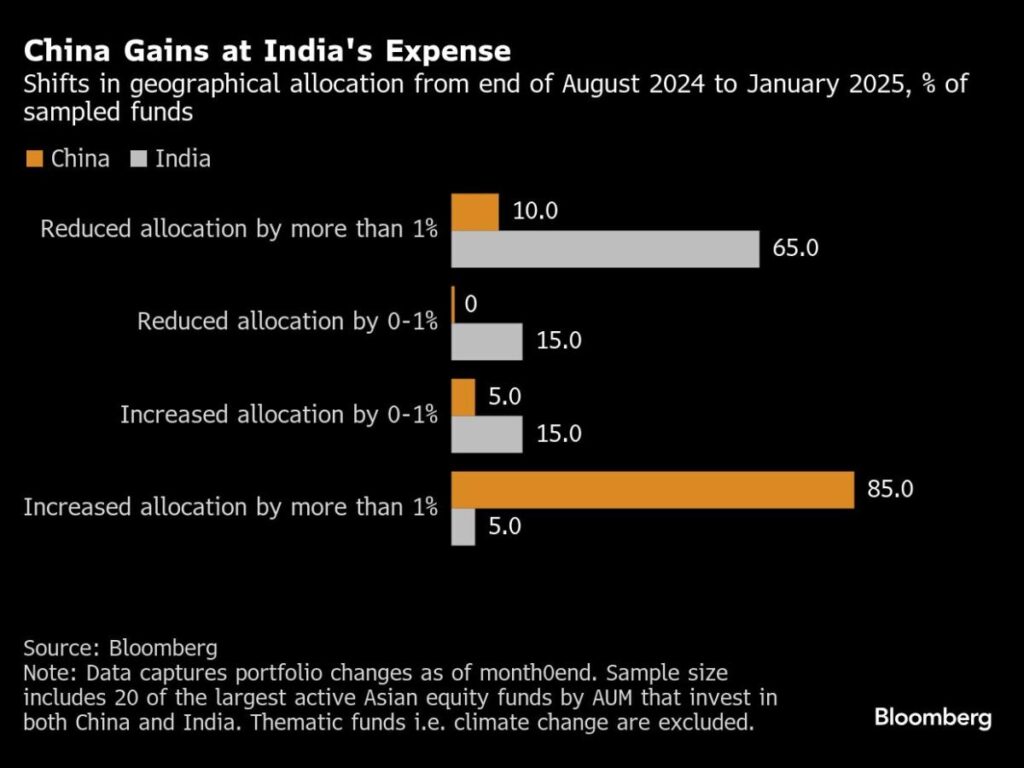

Hedge funds are piling up on Chinese stocks at the fastest pace in months as the bullishness of deep-sec-driven technology rally raises hopes for more economic stimulation. In contrast, India is struggling with record-breaking cash departures over concerns over slowing macro growth and slowing corporate revenues and expensive stock valuations.

China’s land and offshore stock markets have added a total of more than $1.3 trillion in the past month amid such reallocation, while India’s market has shrunk more than $720 billion. The MSCI China Index is on track to surpass its Indian counterpart in the third month, the longest winning streak in two years.

Ken Wong, an Asian Equity Portfolio Specialist at Eastspring Investments, said Deepseek “indicates that there are companies that actually form a key part of the AI ecosystem. His company is , while adding Chinese internet holdings over the past few months, trimming small Indian stocks “running beyond multiples of valuation.”

This rotation invites funding from China in terms of face from pivots to India seen over the past few years. This was based on India’s infrastructure spending splurge and its potential as an alternative manufacturing hub to China. India, which focuses on the country, is also considered a relative heaven in Donald Trump’s tariff plans.

China appears to have regained its previous appeal, particularly with a fundamental reassessment of investment potential in technology. After scaring investors with corporate crackdowns a while ago, Beijing showed in the news that Jack Ma, co-founder of entrepreneurs, including Alibaba Group Holding Ltd., has been invited to meet the country’s top leaders. As has been reported, it may actually help promote new AI themes.

Vivek Dhawan, fund manager at Candriam, said Deepseek-related developments will likely help boost China’s economy and its markets and provide an expanded boost. “By putting all the pieces together, China is more attractive than India in its current setup.

The difference in ratings adds to the appeal of China. The MSCI China Index is trading with a forward revenue estimate of just 11 times, compared to about 21 times the MSCI India Index.

The story continues