Cryptocurrency Exchange Coinbase Global (Coin) reported its fourth quarter 2024 financial results that crushed Wall Street’s target as transactions in Bitcoin (BTC) and other digital assets.

Maximize your portfolio with data-driven insights.

You can leverage the power of Tipranks’ Smart Score, a data-driven tool, to help you discover the best performance and make informed investment decisions. Monitor your stock picks and compare them with topwall street analyst recommendations in your smart portfolio

The company recorded profit per share of $4.68. This was more than twice the $2.11 consensus expectations for analysts tracking the company’s progress. Last year’s final quarter, revenue was $2.27 billion, far surpassing Wall Street’s $1.88 billion estimate. Sales increased 130% from the previous year, marking the company’s largest quarterly revenue in three years.

Transaction revenues at Coinbase more than doubled from last year to $1.56 billion, surpassing the estimates that it called for $1.29 billion. The company’s platform total trading volume in the fourth quarter of 2024 was $439 million, an increase of 185% year-on-year. Consumers (retail investors) trading volume increased 224% from the same period a year ago, while institutional investors trade volume increased 176%.

Crypto Rally

Coinbase’s management team said the very strong quarter was due to a fierce post-election rally that pushed cryptocurrency prices to record levels late last year. Bitcoin and other cryptos have skyrocketed since US President Donald Trump won reelection last November, pledging to guide him into a new era of digital coins and tokens.

Coinbase, which operates the largest US market to buy and sell crypto, praised the continued popularity of its Spot BTC Exchange-Traded Funds (ETF), which first launched almost a year ago. Despite the exceptional prints, coin stock was traded after business hours. Over the past 12 months, the company’s share price has risen 86%.

Do you buy coin stock?

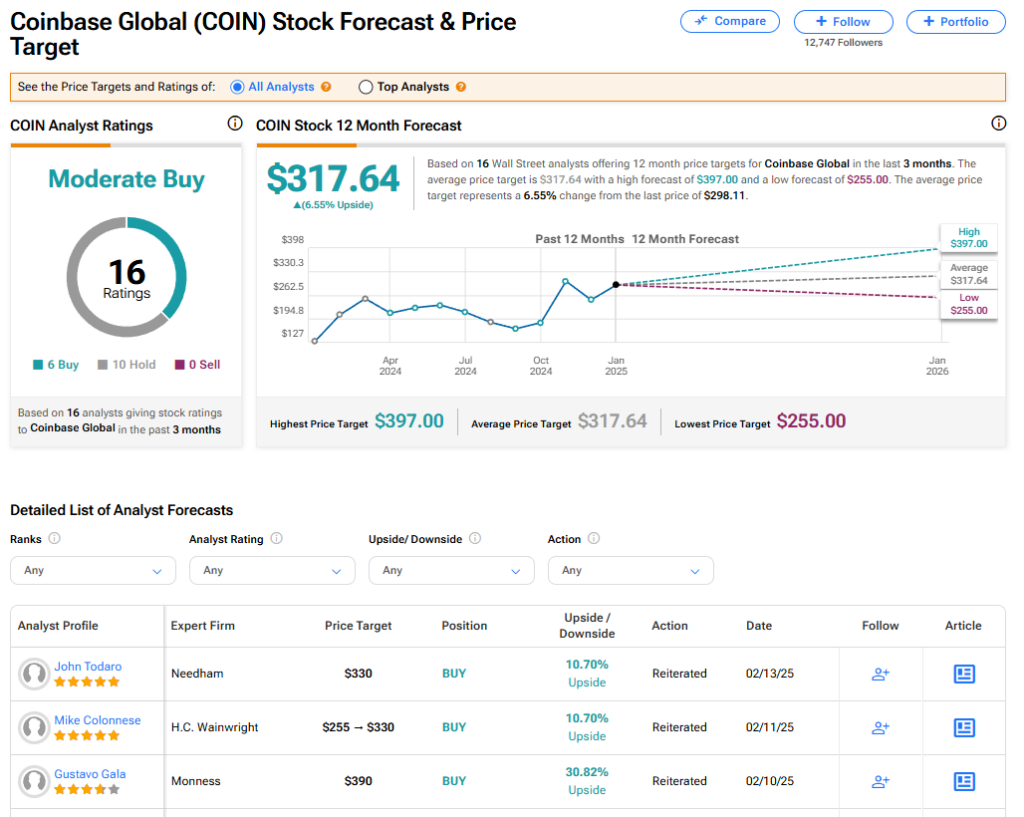

Coinbase Global’s stock has a consensus medium purchase rating among 16 Wall Street analysts. That rating is based on six purchases and 10 holding recommendations issued over the past three months. The average coin price target of $317.64 means a 6.55% increase from the current level. These valuations may change after today’s financial results.

Read more Coinstock Analyst ratings