Stocks in mainland China rose as investors took stock of the Chinese government’s Saturday conference on economic stimulus. The finance minister said additional measures were needed, but gave no details. Japanese markets were closed for the holiday.

S&P 500 futures: 5,866.25 ⬆️ up 0.11%

S&P 500: 5,815.03 ⬆️ up 0.61%

Nasdaq Composite: 18,342.94 ⬆️ up 0.33%

Dow Jones Industrial Average: 42,863.86 ⬆️ up 0.97%

STOXX Europe 600: 522.20 ⬆️ up 0.04%

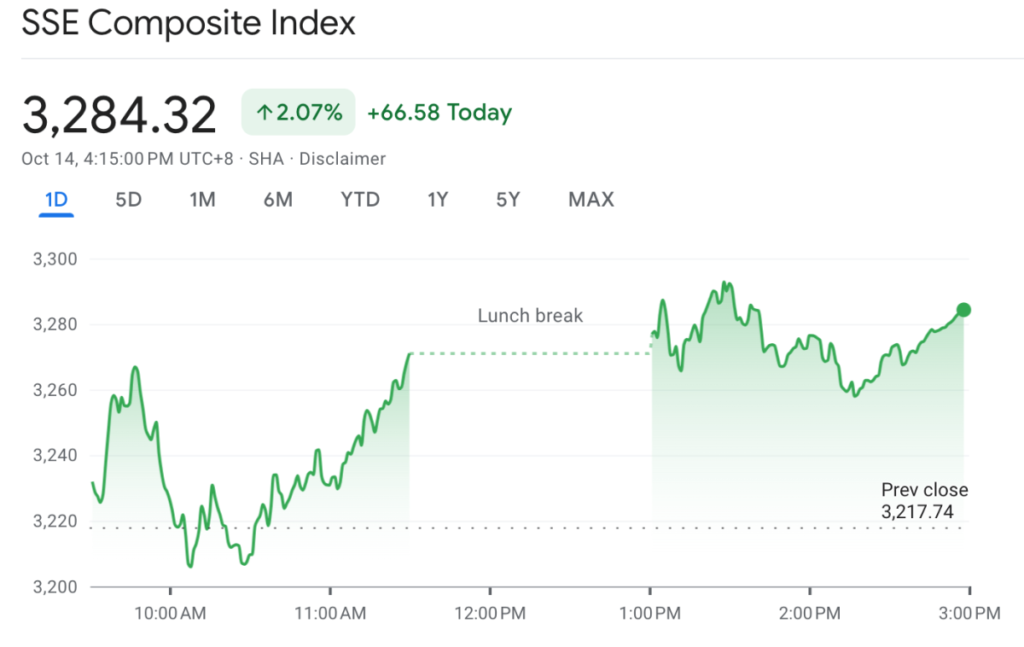

SSE Composite: 3,284.32 ⬆️ 2.07% increase

Bitcoin: $64,588.52 ⬆️ up 2.73%

China: Stock prices rise after economic stimulus briefing

Shanghai’s SSE Composite fell to 2 after Finance Minister Lan Fong-an said at a press conference on Saturday that there was “enough room” for additional spending in the budget and that other policy measures were “being discussed”. It rose by 0.7%. However, he did not specify what kind of stimulus package or its size. China also reported trade figures, with exports in dollar terms increasing at an annual rate of 2.4% and imports increasing by 0.3% in September, both lower than expected. Hong Kong’s Hang Seng fell 0.75%.

Europe: Stocks slump as traders weigh China’s economic stimulus plan and expected interest rate cuts

European stocks were struggling near break-even early Monday as traders digested the lack of explanations and details about China’s stimulus plan. Luxury stocks with heavy exposure to China fell, with LVMH, Hermès and Kering falling more than 2% in the morning. The euro fell slightly against the dollar as the European Central Bank was expected to cut interest rates at its meeting on Thursday. In morning trading, the Stoxx Europe 600 was up 0.04%, while the FTSE 100 was down 0.05%.

US pre-market is mixed after hitting record levels

On Friday, Wall Street ventured into new record territory on the back of strong earnings from financial giants JPMorgan Chase & Co., Wells Fargo & Co., and BlackRock Inc., after investors understood briefings in China and expected further growth from major banks. Major U.S. indexes were mixed in premarket trading Monday as they braced for the increase. income. Tesla, which was punished Friday for its underwhelming robotaxi rollout, rallied 1.7% before the opening bell, while Boeing fell 1.5% on Friday’s announcement of 10% job cuts.

And the financial year-end season continues…

Goldman Sachs, Bank of America and Citigroup will all release numbers on Tuesday. Morgan Stanley reported on Wednesday. Netflix has a turn on Thursday. And on Friday, P&G and American Express will be featured.

This article originally appeared on Fortune.com