email Sign up for our free weekly newsletter

Global real estate consultant Knight Frank says the Caribbean has become a popular destination for property buyers during the pandemic, drawn to its scenic beauty and favorable tax system. This influx accelerated a wave of luxury development and raised the standard of luxury on the islands.

The Bahamas’ Cable Beach is seeing new luxury developments like Rosewood Residences at Baha Mar, where condo owners can enjoy five-star hotel amenities without checking out. Nearby Four Seasons Ocean Club offers prospective buyers a mix of apartments, penthouses and villas surrounded by landscaped Versailles-inspired gardens along 8 kilometers of beach on Paradise Island . These trends demonstrate the impact of the pandemic on the Caribbean real estate market, attracting younger, more mobile buyers freed from traditional office schedules.

“We’re seeing a real shift to condos in the $1 million to $5 million range,” said Susie Vasquez, general manager of Isles Group. “Buyers want a lock-and-leave lifestyle close to the beach or prefer condos to dealing with the upkeep of a separate property during a hurricane.” Buyers with a $10 million budget Even people are choosing condos over traditional homes.

While some of the market impacts of the pandemic, such as executives working remotely, have faded, favorable tax conditions remain a strong attraction. The Bahamas has no income tax, capital gains tax, inheritance tax, or wealth tax. Barbados has a low income tax rate with no capital gains tax. These tax benefits in the Caribbean are even more attractive as other countries, such as the UK and Canada, have increased taxes on the wealthy. Additionally, both Barbados and the Bahamas offered generous visa conditions to remote workers, many of whom stayed and became permanent residents. “We’ve seen families, especially from Canada, buy homes via Zoom, move for a change of pace, and stay because of the quality of life and access to international schools,” Vazquez said. ”.

The popularity of condominiums is also driven by rising housing prices in the Bahamas. Vasquez estimates that prices for independent homes have roughly doubled since 2020. Homes in the charming gated community that once sold for $3 million in 2019 are now selling for more than $6 million. Although some sellers continue to aim for high prices, market activity has slowed and more properties remain on the market.

This trend is spreading throughout the Caribbean. In Barbados, Knight Frank’s local partner Terra Luxury has achieved record results. Luxury real estate priced over $20 million on the island’s west coast is in high demand, with limited availability in prime locations. “It’s almost impossible to find large lots on the West Coast,” says Betty Caslow of Terra Luxury.

Unlike the Bahamas, Barbados does not have large branded homes, and wealthy buyers often prefer to rebuild homes to their own tastes. “Many buyers are tearing down existing properties and building custom homes, demonstrating their desire to make Barbados their permanent home,” said Tariq Brown of Terra Caribbean. Barbados developers are now focusing on locations slightly inland and “just steps from the beach” to appeal to buyers with lower prices than waterfront properties. This includes new villa developments like Calidora near Gibbs Beach, where prices can reach up to $3.25 million.

For those seeking greater privacy, Mustique (a private island owned by Mustique) is an attractive option, although inventory is limited. With just 100 properties, only a few are available each year, with entry-level villas priced at around $6 million and luxury properties selling for up to $30 million. “We control everything on Mustique, from the airport to security. This creates a uniquely secure environment with no locks or keys,” says Roger Pritchard, Managing Director of Mustique. says Mr. Mustique real estate values soared 25% during the pandemic, with sales primarily in the $5 million to $15 million range. But inventory remains tight as younger buyers who invested during the pandemic tend to hold onto properties.

In summary, the Caribbean real estate market is changing and attracting new buyers with unique lifestyles and demands. Tax incentives, the allure of island living, and the luxury of custom homes all played important roles in reshaping these tropical havens.

Key highlights of the Caribbean market report:

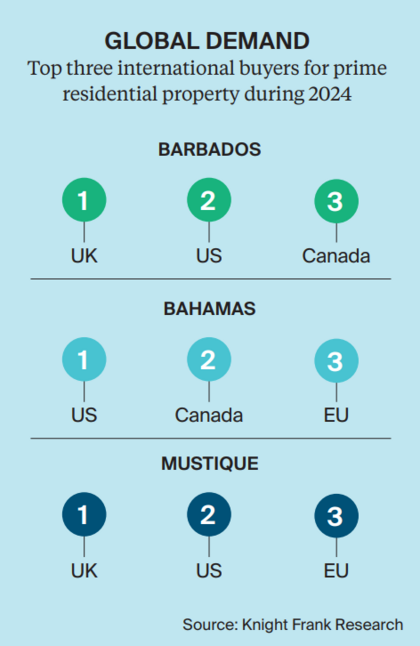

Tax advantages: The Bahamas and Barbados offer attractive tax regimes with no capital gains, inheritance or wealth taxes, attracting high-net-worth individuals (HNWIs) from high-tax countries. Flexible visa programs: Both Barbados and the Bahamas introduced long-term visas during the pandemic, allowing remote workers to live and work in the Caribbean. Many of these temporary residents subsequently became permanent residents, particularly in the Bahamas. Shift to condos: In response to rising real estate values, especially in the Bahamas, buyers are increasingly choosing condos for their convenience and low maintenance costs. Popular investment amounts range from $1 million to $5 million. Global buyer interests: Top buyers come from the US, UK, and Canada and value lifestyle, remote work opportunities, and privacy. The Caribbean’s appeal lies in its natural beauty, luxurious lifestyle, and relaxed tax system. Mustique’s exclusive market: With just 100 properties and tight security, Mustique offers a secluded setting, preferred by wealthy individuals who prioritize privacy and security, and commands some of the highest real estate values in the region. I’m proud.

High demand for limited land: Barbados faces intense competition for limited land, especially on the west coast, and developers are increasing prices to cater to high-end and ultra-luxury buyers seeking vacation homes and second homes. leading to an increase.