This is the public version of the weekly Forbes Crypto Confidential Newsletter. Sign up here to get Crypto Confidential delivered to your inbox for free a few days in advance.

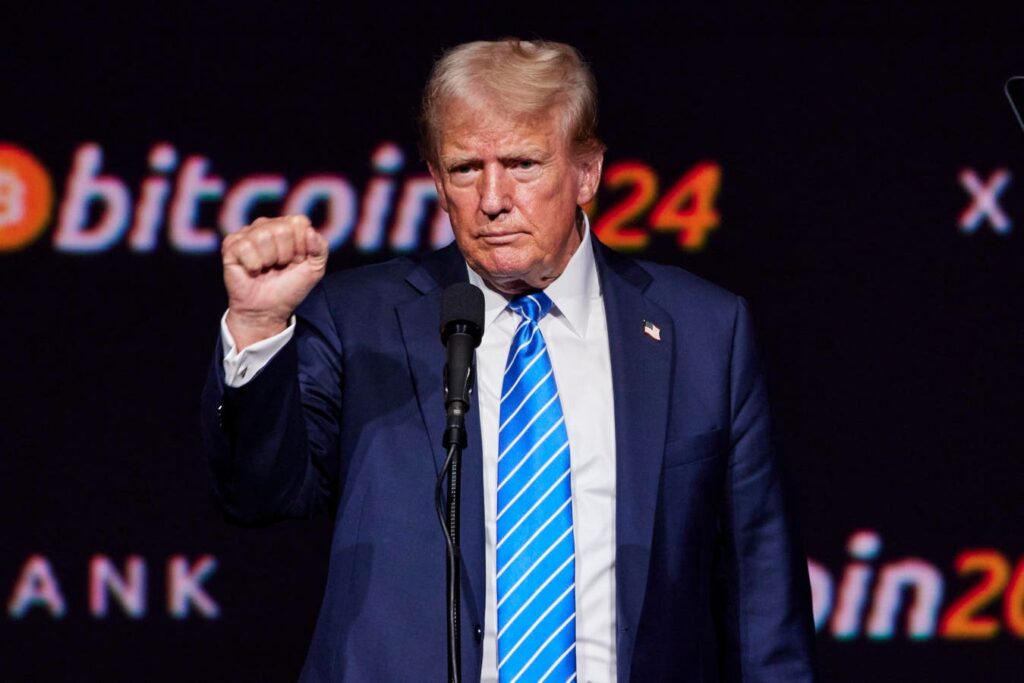

Donald Trump at the 2024 Bitcoin Conference in Nashville, Tennessee. (Photo by Johnny Izquierdo for The Washington Post, via Getty Images)

Washington Post (via Getty Images)

Bitcoin surpasses $105,000

Bitcoin soared above the $105,000 mark on Friday, ending a slump that briefly fell below $90,000, and just gaining momentum toward a 2025 high. The rebound is fueled by expectations that President-elect Donald Trump will change the US scenario regarding cryptocurrencies after taking office on Monday.

Trump’s campaign promises include a complete national stockpile of Bitcoin and turning the United States into a global cryptocurrency leader, a fundamental departure from the Biden administration’s crackdown. He is reportedly preparing an executive order that would declare digital assets a policy priority and establish an advisory committee of industry players.

Trump quickly became the crypto world’s new best friend, collecting donations from Circle, Ripple, and other big companies for his inaugural committee. They even threw “cryptoballs” in Washington, D.C., on Friday, showing that the industry’s influence on Capitol Hill is stronger than ever.

XRP reaches all-time high

XRP, the Ripple Labs-linked token and the third-largest cryptocurrency, rose nearly 40% this week to an all-time high of $3.4, outperforming every other major digital asset this month. The company’s market capitalization now stands at around $190 billion, buoyed by optimism that the Trump administration may adopt more crypto-friendly policies.

Ripple CEO Brad Garlinghouse recently told the New York Times that he had dinner with Trump at Mar-a-Lago and encouraged him to create a federal stockpile of cryptocurrencies, including XRP. Ta. Ripple has just launched RLUSD, a new stablecoin on both the XRP ledger and Ethereum. Talk about double down.

San Francisco-based Ripple Labs was sued by the SEC in 2020, accusing it of offering unregistered securities. A U.S. district court ruling ruled that XRP is considered a security when sold to institutional investors, but not to retail investors, marking a partial victory for the crypto industry. Ta. The SEC is appealing this decision, but with a more crypto-friendly SEC chair expected to be installed, the future of the appeal could be uncertain.

Coinbase makes new move with Bitcoin-backed loans

Coinbase has once again opened its doors to Bitcoin-backed loans. Customers in the United States (excluding those in New York) can now borrow up to $100,000 worth of stablecoins (USDC) through the Coinbase-developed blockchain lending protocol Morpho on Base.

Your Bitcoin will be wrapped into “cbBTC” and shipped to Morpho, after which USDC will appear in your Coinbase account. With standard DeFi disclaimers, these steps will likely take less than a minute. These loans must be over-collateralized and interest rates will vary depending on market fluctuations. If the loan reaches 86% of the collateral value, the Bitcoin may be liquidated to cover the outstanding balance and penalties. But for loyal Bitcoiners, this might be worth it. Selling now, when Bitcoin is up 146% over the past year, would mean triggering a tax event.

Coinbase tried a version of this scheme with its Borrow program in 2020, but it failed to gain traction and shelved it for retail customers in 2023. This new version adds even more appeal to DeFi with plans to expand collateral types and open up to more markets.

Elsewhere:

Pension funds are dabbling in cryptocurrencies after Bitcoin’s massive rally (Financial Times)

Some US banks start doing business with virtual currency companies (information)

Crypto industry throws party for President Trump in Washington DC (Bloomberg)