Almost no one noticed, but a tech giant you’ve probably never heard of kicked Tesla out of the much-hyped Magnificent Seven. Can I stay there?

An overlooked Magnificent Seventh is Broadcom, a technology company that manufactures both hardware and software. It’s well known in the infotech world, but not well known outside of it. The Magnificent Seven was conceived as a stock group in early 2023 and is the most valuable US tech company by market capitalization. In descending order, they include Apple (recent market cap: $3.4 trillion), Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla (recent market cap: $768 billion). But Broadcom’s market capitalization overtook Tesla’s last spring and has remained above the EV maker’s for most of this year. The current market capitalization is approximately $803 billion.

There’s no guarantee that Broadcom will stay ahead of Tesla, at least in the short term. Tesla’s stock price is notoriously volatile, and its market capitalization could temporarily exceed Broadcom’s stock price. However, Broadcom’s long-term outlook is by far the brighter of the two companies. On average, Wall Street analysts expect Tesla’s stock price to continue to rise, while they expect Tesla’s stock price to continue to fall. While Tesla’s stock price has retreated to where it was almost four years ago, Broadcom’s stock has risen 290% since then.

So how did this quiet giant sneak into the pinnacle of tech royalty? Primarily through a combination of technology savvy and financial acumen. The company is the grandson of Hewlett-Packard. The company spun off a company called Agilent Technologies in 1999 and spun off a company called Avago into two private equity firms in 2005. Avago began acquiring semiconductor companies and acquired them in 2015. The big company is called Broadcom and goes by that name.

Broadcom’s PE ancestors have guided Broadcom ever since its spinoff. “Broadcom operates much like a private equity firm, investing in assets that deliver quick returns,” said Naveen Chhabra, an analyst at research and consulting firm Forrester. “It’s smart in terms of investing in companies that can maintain or grow revenue,” while also “turning the company into a profitable business.”

View this interactive chart on Fortune.com

Exhibit A is Broadcom’s biggest acquisition, cloud computing company VMware, acquired last November. A Forrester report for VMware customers warns: “Don’t be shocked by price increases. In most cases, customers will find that their renewal quote is several times what they paid in the past.”

Wall Street approves of Broadcom’s changes. “They seem to be crushing the performance on VMware,” said Bernstein analyst Stacey Rasgon. “This quarter’s results were significantly better than expected and they appear poised for continued growth.” said.

the story continues

Shrewd acquisitions and management have been central to Broadcom’s growth, but that alone doesn’t fully explain the company’s staggering market capitalization. Another key factor is, of course, the enthusiasm for AI. One of Broadcom’s most important businesses is designing semiconductors, or computer chips, which have been in high demand over the past year. Broadcom’s AI chip sales in 2023 were $4.2 billion, according to a report from BofA Securities. The company expects AI chip sales to jump to $12.1 billion this year and $16.9 billion next year.

Because of Broadcom’s chip expertise and VMware’s success, Broadcom’s market cap was slightly above McDonald’s when OpenAI released ChatGPT in November 2022, but now it’s the Magnificent Seven. has been pushed to the level of

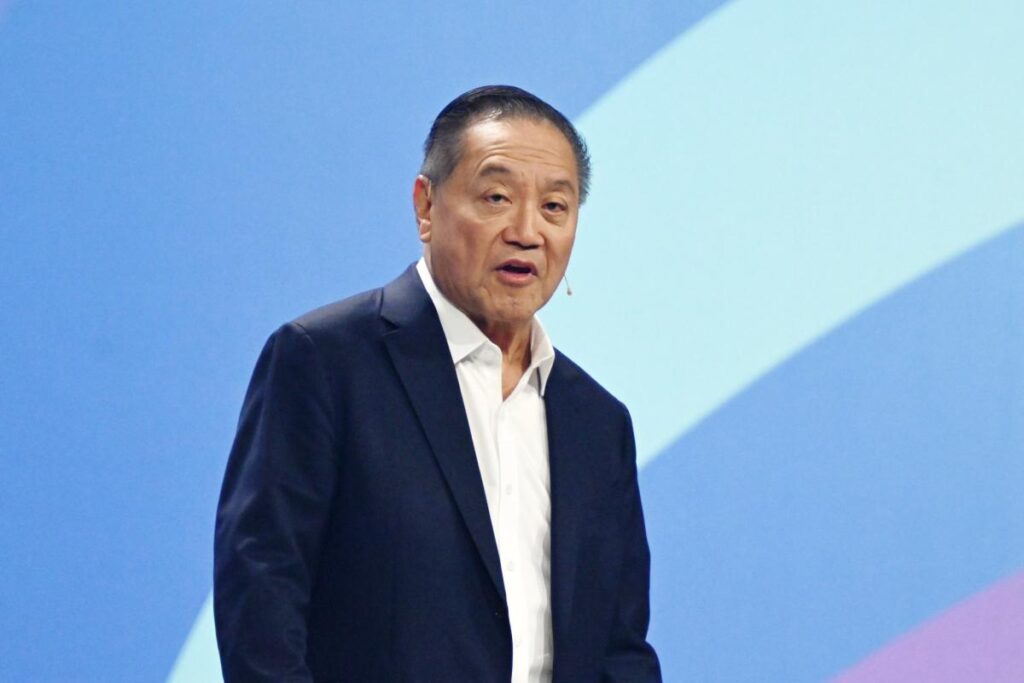

A key element to Broadcom’s success and its future is CEO Hock Tan, who was hired to run the company when Avago was spun off in 2005. The 72-year-old was born in Malaysia and holds an engineering degree from MIT and an MBA from Harvard University. business school. Although he has spent most of his career in technology companies, he has also held finance positions at PepsiCo and General Motors, giving him the company’s shared expertise in technology and finance. In recent years, Tan has become one of the highest-paid CEOs in the United States. He earned $162 million last year. Finding a successor is an obvious issue for the company, but the successor is not yet clear. Mr Tan said he plans to continue running the company for at least another four years.

Wall Street analysts are largely rooting for Broadcom. “The numbers are likely to continue to rise,” Bernstein’s Rasgon said. “And valuations are becoming increasingly attractive.” JPMorgan’s Harlan Suhl said the stock “remains our top semiconductor stock.”

There are no trees reaching for the sky, but for now the sun shines brightly on this company. Beyond that, the only certainty is that Broadcom can no longer remain anonymous.

This article originally appeared on Fortune.com