(Bloomberg) — Bond traders have rarely been hit so hard by the Federal Reserve’s easing cycle. They now fear more of the same will happen in 2025.

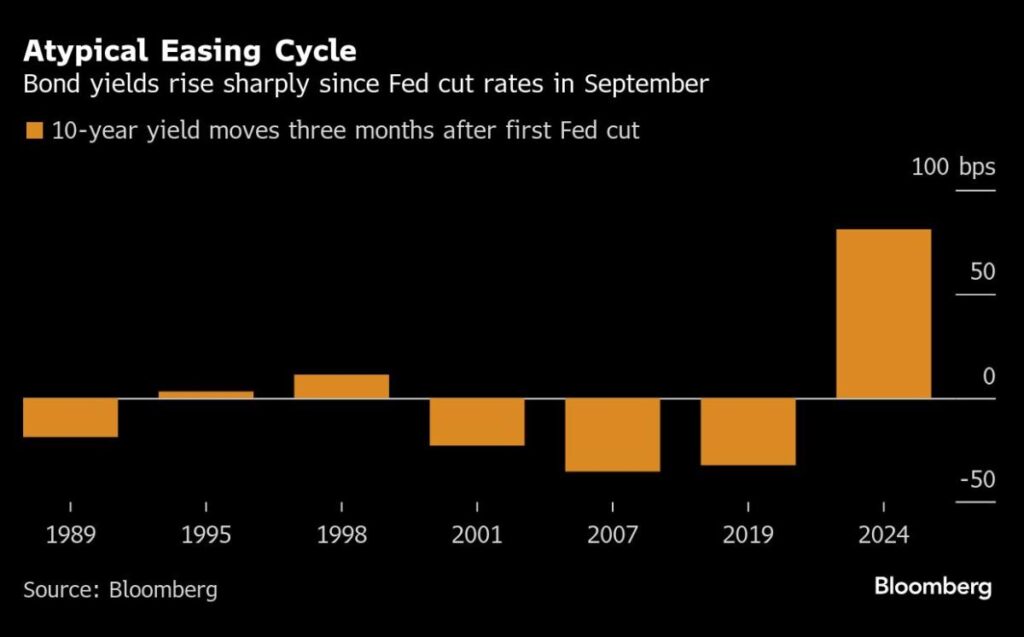

U.S. 10-year Treasury yields have risen more than three-quarters of a percentage point since central bankers began lowering benchmark interest rates in September. This was a counterintuitive and loss-inducing reaction, marking the biggest increase in the first three months of a rate cut cycle since 1989.

Last week, the 10-year Treasury yield rose as policymakers led by Chairman Jerome Powell signaled they were prepared to significantly slow the pace of monetary easing next year, despite the Fed cutting rates for the third time in a row. has risen to its highest level in seven months.

“Treasuries have been repriced in response to rising long-term rates and a more hawkish view from the Fed,” said Sean Shimko, global head of fixed income portfolio management at SEI Investments, driven by rising long-term yields. He said he expects this trend to continue.

The rise in yields highlights how unique this economic and financial cycle is. Despite rising borrowing costs, economic resilience has kept inflation stubbornly above the Fed’s target, leading traders to abandon bets on aggressive rate cuts and abandoning hopes for a broad-based rally in bonds. I am forced to do so. After a year of wild ups and downs, traders are now staring down another year of disappointment, with U.S. Treasuries as a whole barely breaking even.

The good news is that popular strategies that worked well during past easing cycles are gaining new momentum. The trade, known as a curve steepener, is a bet (as is common these days) that short-term Treasury bonds, which are more susceptible to the Fed, will outperform longer-term Treasuries.

Otherwise, the outlook is grim. Bond investors not only have to contend with a Fed that is likely to remain on hold for some time, but also the potential for disruption from the administration of President-elect Donald Trump, who has vowed to rebuild the economy through policies ranging from trade to immigration. is also facing. Many experts see it as inflation.

“The Fed has entered a new phase of monetary policy, a pause phase,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. “The longer this situation lasts, the more likely the market will be forced to equate rate hikes and rate cuts. Policy uncertainty will make financial markets even more volatile in 2025.”

Bloomberg strategist says…

The last Federal Reserve meeting of the year is coming up, and its outcome is likely to support a steeper curve into the year. When President Donald Trump takes office in January, there is room for power relations to stagnate amid uncertainty over new government policies.

—Alice Andres Read more about MLIV

Bond traders were caught off guard last week when Fed policymakers signaled more caution about how quickly they can continue cutting borrowing costs as inflation concerns persist. Fed officials decided to cut interest rates by just two quarter points in 2025, after lowering them by 1 percentage point from a 20-year high. Fifteen out of 19 Fed officials see upside risks to inflation, compared to just three in September.

Traders quickly readjusted their interest rate expectations. Interest rate swaps showed traders were not fully pricing in further rate cuts until June. They expect total rate cuts next year to be about 0.37 percentage points, less than half a percentage point of the median forecast on the Fed’s so-called dot plot. However, in the options market, trading flows are skewed towards a more dovish policy path.

Bloomberg’s U.S. Treasury benchmark fell for the second week in a row, erasing most of this year’s gains, with long-term bonds leading the decline. U.S. government debt has fallen by 3.6% since the Fed began cutting interest rates in September. Bonds, by contrast, have posted positive returns in the first three months of each of the past six easing cycles.

The recent decline in long-term bonds hasn’t attracted many bargain hunters. JPMorgan Chase strategists led by Jay Barry recommended that clients buy two-year bonds, but will buy longer maturities, citing a lack of key economic data in the coming weeks. “I don’t feel it was forced,” he said. As trade thins towards the end of the year, fresh supply also dwindles. The Treasury Department plans to auction off $183 billion worth of securities in the coming days.

The current environment creates perfect conditions for a steeper strategy. At one point last week, the yield on the 10-year U.S. Treasury was a quarter of a point above the yield on the two-year Treasury, the biggest difference since 2022. The gap narrowed slightly on Friday after data showed the Fed’s recommended inflation measure advanced at its slowest pace last month since May. But trade is still the winner.

The logic behind this strategy is easy to understand. Investors are starting to see value in the so-called short end, as the two-year bond yields 4.3%, about the same as its cash equivalent, the three-month Treasury bill. But two-year bonds have the added benefit of potentially rising in price if the Fed cuts rates more than expected. They also offer value from an overall asset perspective, given the high valuations of US stocks.

“The market certainly views bonds as cheap relative to stocks and as insurance against an economic slowdown,” said Michael de Pass, global head of interest rate trading at Citadel Securities. “The question is, how much do you have to pay for that insurance? Right now, if you look at the front end, you don’t have to pay a lot of money.”

Long-term bonds, by contrast, have struggled to attract buyers due to persistently high inflation and a still-strong economy. Some investors are also wary of President Trump’s policy platform and its potential to not only boost growth and inflation, but also exacerbate already large budget deficits.

“Long-term yields could certainly rise once we start factoring in President-elect Trump’s administration and spending,” said Michael Hunstad, deputy chief investment officer at Northern Trust Asset Management, which manages $1.3 trillion. and will rise,” he said.

Hunstad said he supports inflation-linked bonds as “fairly cheap insurance” against rising consumer prices.

what to see

Economic data:

December 20: University of Michigan Consumer Confidence Survey (Final). Kansas City Fed Service Activities

December 23: Chicago Fed National Activity Index. Conference Board Consumer Confidence

December 24th: Building permit. Philadelphia Fed Nonmanufacturing Activities. Durable consumer goods. Newly built home sales. Richmond Fed Manufacturing Index and Business Conditions

December 26: First unemployment claim filed.

December 27: Prepaid goods trade balance. Wholesale, retail inventory

Auction calendar:

December 23: Invoices for 13, 26, and 52 weeks. 42-day cash management bill. 2 years worth of notes

December 24th: FRN restarts after 2 years. 5 year memo

December 26th: 4 week, 8 week, and 17 week bills. 7 years worth of notes

–With assistance from Edward Bolingbroke.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP