Ariel Investments, an investment management company, has released its Investor Letter for the second quarter of 2024 for the “Ariel Global Fund”. A copy of the letter can be downloaded here. In the second quarter, the Ariel Global Fund fell -3.12%, underperforming its primary benchmark, the MSCI ACWI Index, which returned +2.87%, and its secondary benchmark, the MSCI ACWI Value Index, which returned -0.59%. Ariel takes a non-consensus approach to identify undervalued and unpopular franchises that are misunderstood and mispriced. Additionally, to learn about the best picks for 2024, check out the fund’s top five holdings.

Ariel Global Fund featured stocks such as Intel Corporation (NASDAQ:INTC) in its Q2 2024 investor letter. Intel Corporation (NASDAQ:INTC) designs, develops, manufactures, markets, and sells computing and related products and services. Intel Corporation (NASDAQ:INTC) had a one-month return of -34.71% and a 41.88% decline in the past 52 weeks. On August 27, 2024, Intel Corporation (NASDAQ:INTC) stock closed at $20.07 per share, with a market capitalization of $85.819 billion.

In its Q2 2024 investor letter, Ariel Global Fund said the following about Intel Corporation (NASDAQ:INTC):

“Meanwhile, several positions weighed on results. Intel Corporation (NASDAQ:INTC), one of the world’s largest semiconductor chipmakers by revenue, saw its results weaken during the period following news that its foundry business’s profitability recovery will take longer than expected. This was exacerbated by disappointing short-term guidance due to a weakening demand environment that suggests an extended replacement cycle. We view the quarter as a temporary trough that should be eliminated as we see signs of a cyclical recovery in personal computers (PCs) and central processing units (CPUs) driven by the Windows 11 upgrade. In our view, the market is overlooking Intel’s ongoing advances in its manufacturing process, not to mention the company’s efforts to serve as a viable second-source foundry partner for cutting-edge silicon. We believe the separation of its design and manufacturing businesses will be an important catalyst to realizing improved financial performance while enhancing the competitiveness of its foundry business.”

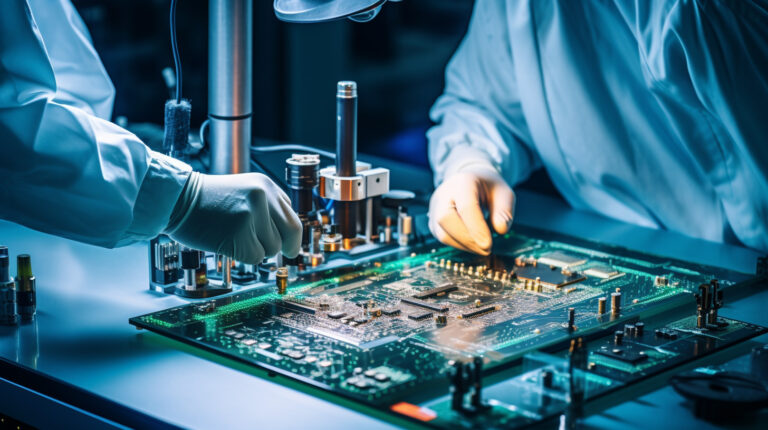

A technician solders components onto a semiconductor board.

Intel Corporation (NASDAQ:INTC) is not included in our list of the 31 most popular stocks among hedge funds. According to our database, 75 hedge fund portfolios held Intel Corporation (NASDAQ:INTC) at the end of the second quarter, up from 77 in the previous quarter. Intel Corporation (NASDAQ:INTC) posted second-quarter revenues of $12.8 billion, down 1% year-over-year and up 1% quarter-over-quarter. While we recognize the investment potential of Intel Corporation (NASDAQ:INTC), we believe AI stocks offer a better chance of delivering higher returns in the short term. If you are looking for AI stocks that are as promising as NVIDIA but trade at less than 5x, check out our report on the cheapest AI stocks.

The story continues

In another article, we discussed Intel Corporation (NASDAQ:INTC) and shared the list of stocks that hedge funds are buying and selling. Additionally, you can find more details on investor letters from hedge funds and other leading investors on our Q2 2024 Hedge Fund Investor Letters page.

Read next: Michael Burry sells these stocks and a new dawn dawns for US stocks.

Disclosures: None. This article was originally published on Insider Monkey.