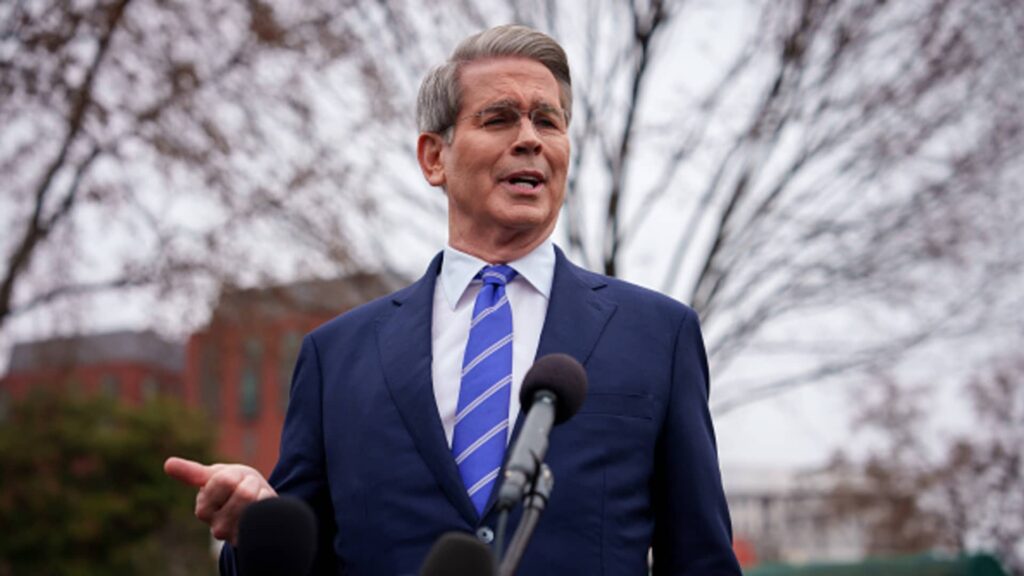

Treasury Secretary Scott Bescent said Thursday that the Trump administration is focusing more on the long-term health of the economy and markets, rather than on the short-term turnover.

“We’re focusing on the real economy. Can we create an environment where the market has long-term benefits and the Americans have long-term benefits?” Bescent said in CNBC’s “Squad Work on the Streets.” “I’ve not been worried about a bit of volatility over the course of three weeks.”

Comments come to markets that are primarily in chaos, mainly focusing on nearly day movements on tariffs on major US trading partners such as Canada, Mexico and China. Large averages moved towards the correction area Dow Jones Industrial Average We have lost more than 7% in the past month.

Bessent said the administration is paying attention to market movements, but he predicted that both the actual economy and the market will flourish over time.

“The reason stocks are safe and big investments is because we look at them in the long term. When we start watching Micro Horizon, stocks become extremely dangerous. So we’re focusing on the medium, long term,” he said in an interview with CNBC’s Sara Eisen. “If we put in place the right policies, we can say that we will lay the foundation for both real income improvements and employment benefits and ongoing assets benefits.”

As Bescent said, inventory was once again volatile in the morning trade, with average being average.

Early in the morning, the Bureau of Labor Statistics reported that wholesale inflation rates rose 0.3% in February, significantly below Wall Street’s expectations. It followed Wednesday’s report, showing that consumer price rates also fell, providing welcome news amid concerns that Trump’s tariffs would exacerbate inflation.

“Maybe inflation is controlled and the market will have some confidence in it,” Bescent said.