BBC News, Mumbai

Getty Images

Getty ImagesNext month, millions of Americans may have to pay more urgent medical costs as Donald Trump’s helpless tariffs looms on India.

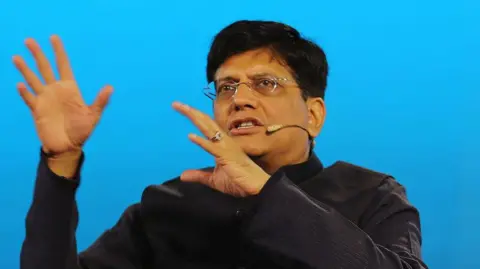

Last week, Indian Commerce Minister Piyush Goyal made an unplanned trip to the US for discussion with authorities, hoping to win a trade deal.

He is the government tax in India following Trump’s announcement that he will impose tariffs to retaliate against tariffs on Indian American goods by April 2nd.

Goyal wants to avoid tax hikes in India’s important export industries, such as drugs.

Almost half of all generic drugs photographed in the US come from India alone. Common Drugs – Cheaper branded drugs are imported from countries like India and account for nine of the 10 prescriptions in the US.

This saves Washington billions of dollars in healthcare costs. In 2022 alone, savings from Indian generics reached an astounding $21.9 billion (£169 billion), according to a survey by IQVIA consulting firm.

Without a trade contract, Trump’s tariffs could prevent Indian generics from being held in several general meetings, causing businesses to withdraw some of the market, exacerbate existing drug shortages, experts say.

Tariffs can “advance the imbalance in demand supply,” leaving uninsured and poor people counting costs, says Dr. Melissa Barber, a drug cost expert at Yale University.

The effects can be felt in people suffering from a variety of health conditions.

According to an IQVIA survey funded by the Indian Drug Union (IPA), more than 60% of prescriptions for high blood pressure and mental health illnesses in the United States were filled with Indian-made drugs.

Sertraline, the most prescribed antidepressant in the United States, is a prominent example of how Americans rely on Indian supply of essential drugs.

Many of them cost half the cost of people from non-Indian businesses.

“We’re worried about this,” says Peter Mabalduc, a civilian lawyer, a consumer advocacy group fighting for access to medicines. One in four American patients have not already taken the medication due to costs, he adds.

Trump is reportedly facing pressure from US hospitals and common drug manufacturers due to tariffs on Chinese imports.

87% of the raw materials of drugs sold in the US are overseas and concentrated primarily in China, meeting around 40% of the world’s supply.

Since Trump took office, tariffs on Chinese imports have risen by 20%, so the costs of drug raw materials have already risen.

Getty Images

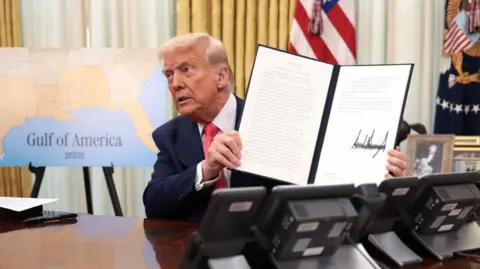

Getty ImagesTrump hopes businesses will move manufacturing to the US to avoid his tariffs.

Large pharmaceutical companies like Pfizer and Elilily, who sell brand names and patented drugs, say they are committed to moving some manufacturing there.

However, the economics of low-value drugs do not sum up.

Dilip Shanghvi, chairman of India’s biggest drug maker, Sun Pharma, told industry gatherings last week that his company is selling tablets in the US for between $1 to $5 per bottle, “and does not justify moving manufacturing to the US.”

“India’s manufacturing is at least 3-4 times cheaper than the US,” said IPA’s Sudarshan Jain.

Quick relocation becomes impossible in the next place. According to Lobby Group Phrma, building a new manufacturing facility costs up to $2 billion and takes five to ten years to become operational.

Getty Images

Getty ImagesFor local Indian pharma players, the tariff blow can also be brutal.

The pharmaceutical sector is India’s largest industrial export, according to GTRI, a trade research institute.

India exports approximately $12.7 billion worth of drugs to the US each year, effectively paying no tax. However, US drugs coming to India pay 10.91% on duty.

This leaves a 10.9% “different transactions.” Mutual tariffs by the US will increase the costs of both generic and special drugs, according to GTRI.

Drugs are flagged as one of the sectors most vulnerable to price rises in the US market.

Indian companies that sell most generic drugs already work at thin margins and can’t afford sudden taxes.

They sell at much lower prices than their competing peers, and are steadily gaining control in cardiovascular, mental health, dermatology and women’s health medications in the world’s largest pharma market.

“Cost cuts can offset single-digit tariff hikes, but the higher ones need to be passed on to consumers,” the finance chief of India’s top drug maker who doesn’t want to be identified told the BBC.

North America is the largest revenue stream, contributing to a third of the revenue and profitability of most companies.

“This is the fastest growing market and is most important. Increased exposure to other markets will not adjust for losses in the US market,” the Treasury Director said.

Umang Vohra, CEO of Cipla, India’s third largest pharmaceutical company, said at a recent rally that tariffs should not ultimately decide what businesses will do.

However, four years was a long time and was able to create and tear down the fortunes for several companies.

Getty Images

Getty ImagesTo avoid this, “India should drop tariffs on Pharma goods,” veteran market expert Ajay Bagher told the BBC. “The impact is negligible as US drug exports are only $5 billion.”

The IPA, which consists of India’s largest drug manufacturers, also recommends a zero obligation to US drug exports so that India is not adversely affected by mutual taxation.

Indian Prime Minister Narendra Modi’s government recently added 36 life-saving drugs to its list of medicines completely exempt from basic budget tariffs, and President Trump dropped hints last week that India could succumb to his pressure.

India has agreed to cut the tariffs “roads,” he said.

Delhi has not responded yet, but pharmaceutical players from both countries are nervously waiting to see details of trade contracts that could be related to their lives and livelihoods.

“In the short term, there may be some pain from the new tariffs, but I think we will make great progress by this fall for the first tranches agreement of the year,” former US trade aide Mark Linscott told the BBC, adding that neither country can break down the supply chain of Pharma.

Follow BBC News India on Instagram, YouTube, X and Facebook.