Top Line

Nvidia disclosed its first financial results on Wednesday, submitting its long-awaited revenue report, showing early how it will emerge from the release of its technology-intensive deepseek AI model from China, leading to the AI giant struggling with the biggest one-day loss of market value in market history last month.

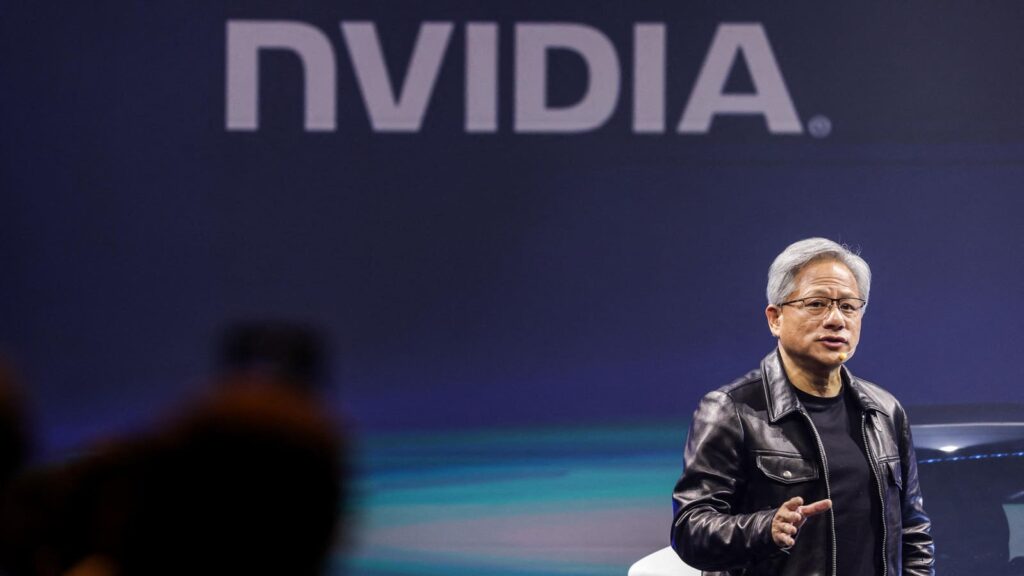

Jensen Huang is CEO and co-founder of Nvidia’s Centibillionaire.

AFP via Getty Images

Important facts

In the fourth fiscal quarter last month, NVIDIA reported revenue of $39.3 billion, adjusted earnings of $0.89 per share, and net income of $22.1 billion.

According to factset data, consensus analyst estimates required NVIDIA to report revenue of $38.1 billion and adjusted profit of $0.85 ($19.6 billion).

Nvidia’s DataCenter unit, including the company’s graphics processing units (GPUs), powered by the most generated AI models, has resulted in sales of $35.6 billion and disrupted the $33.5 billion forecast.

The company said it expects to donate or take 2% in the spring quarter, compared to Wall Street’s estimated $42.7 billion.

In the revenue release, Nvidia CEO Jensen Huang was called Demand “Amazing” for his company’s Blackwell GPU system, which came to the market late last year.

Despite the company’s full beat, Nvidia’s shares trade slightly lower outside of business hours, with Chief Financial Officer Colette Kress, due to DataCenter Division’s “moving to a more complex and more costly system,” which could be attributed to a slight decline in the company’s gross profit margin.

tangent

This was Nvidia’s weakest top and bottom line growth since the quarter ended in April 2023. Nvidia’s growth is a very strong expansion for companies of Nvidia’s size, despite its slower pace as Apple recently reported by Apple, a company with a higher market value than Nvidia.

Big numbers

$72.9 billion. This is the net profit Nvidia brought in during the year ended last month, a jump of 145% year-on-year. This is a final final increase of 875% from the fiscal year ending in January 2023 as Nvidia took off during the AI rush.

Nvidia shares shaking ahead of earnings

Nvidia’s shares rose nearly 4% during regular trading on Wednesday, closing at $131.28. However, Nvidia, a $3.2 trillion market capitalization, has registered its lowest intraday stock price since Tuesday February 3rd after a weekly downstart, falling by around 3% on Monday and Tuesday. This week’s loss comes as tech stocks have been pulled back widely amid growing uncertainty among investors over uncertainty from President Donald Trump’s economic agenda. NASDAQ has dropped by more than 1% each on Monday and Tuesday as the index has closed at its lowest level since late November. Nvidia’s stock entered revenues navigating an unusually downstretch, and after Wednesday’s uptick, trading below about 10% ahead of its latest revenue report in November. Inventory also fell nearly 10% last month during Deepseek’s sale as the market expressed concerns about high-performance AI models that could be run with less NVIDIA’s expensive semiconductor technology. The revenue report was a “large” test of a wobble stock market that perceived “heavy and negatively distorted” by a Wedbush analyst led by Dan Ives in a memo on Tuesday.

Contra

Heading towards earnings, analysts remained predominantly optimistic about Nvidia stock despite recent retention patterns. The average price target of $175 among the 68 analysts tracked by FactSet shows a 38% rise from Nvidia’s stock on Tuesday. Wednesday’s revenue call “may mark a trough of investor sentiment,” predicted Bank of America Analyst, led by Vivek Arya, one of Wall Street’s most outspoken Nvidia Bulls, with a price target of $190.

Important background

California-based Nvidia has become the poster child of the last decade of AI revolution as a leading designer of large-scale models of technology training. Analysts at Morgan Stanley estimate that Nvidia will win around 95% of the $158 billion GPU market in 2025. Nvidia’s dominant market share was the best-performing stock of 2023 and 2024 among the S&P stocks in 2023 and 2024, and performed best during these years. However, Nvidia has not surpassed the broader market recently, increasing 3.7% over the past six months, worsening the S&P 500’s 6.7% return. Huang, the world’s 13th most abundant person, downplayed negative investors’ responses to Deepseek’s release, saying last week that the idea of AI spending slower is a true “completely against”;

Read more