Key takeout

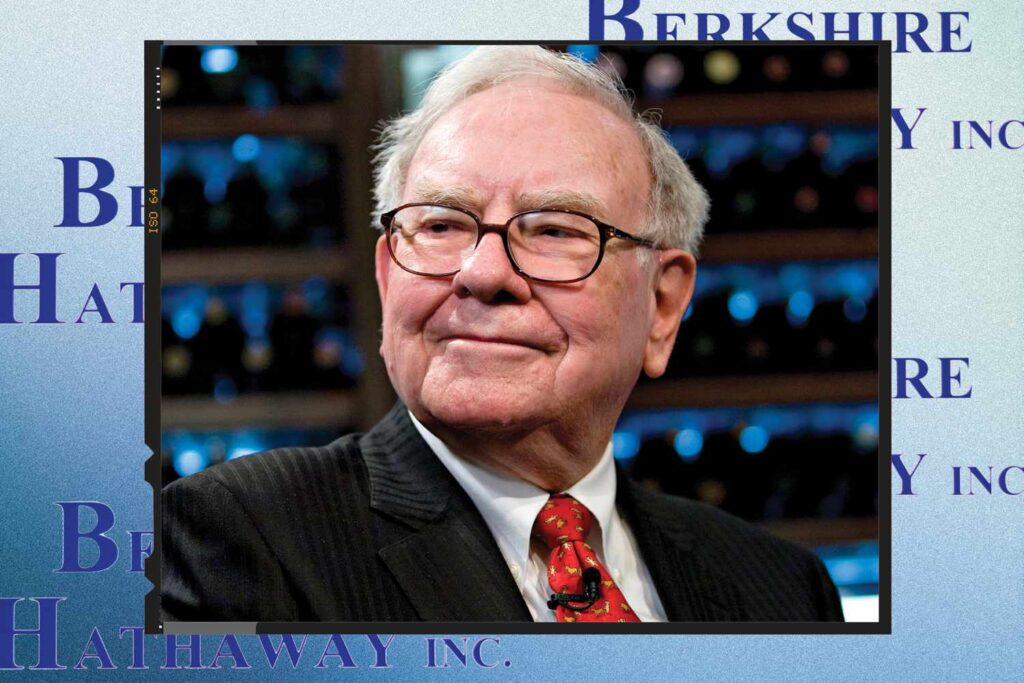

Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B) entered a new position in the beer and spirits maker Constellation Brand (STZ) in the fourth quarter of 2024, trimming several stakes to Ulta Beauty I left (Ulta).

After a significant cut in Apple’s (AAPL) stock throughout the year, Berkshire did not make any changes to its position in the last three months of the year, confirming a filing of 13-F on Friday. The iPhone maker is Berkshire’s top holdings, worth more than $75 billion or about 28% of Berkshire’s portfolio.

Form 13-FS is a quarterly filing that provides only a snapshot of the portfolio to money managers of large institutions at the end of the quarter. This particular application to Berkshire does not reflect any changes the company may have made since the end of December, nor does it shed any light on profits or losses from the stock sales.

New bets on Constellation Brands will be added to Domino’s Occidental

Berkshire has added 5.6 million shares of Constellation Brands, the maker of modelo beer. The shares were worth $1.24 billion at the end of the year. Constellation Brands shares rose more than 6% in extended trading on Friday after the shares went public.

Sitting in a record-breaking cash pile, Buffett’s company used some of its $320 billion dry powder. I bought over 12 million shares of satellite radio provider Sirius XM (SIRI) and added a bit to the stock of Verisign Inc (VRSN).

Berkshire has increased Pool Corp. (Pool) Holdings by almost 50%, but its $200 million shares remain relatively small. Berkshire also bought an additional 1.1 million shares on Domino’s Pizza (DPZ), nearly doubled the company’s shares, and now owns around 6.9%.

For the last three months of last year, Berkshire increased its Oxy shares by nearly 8.9 million shares. A separate filing earlier this month saw Buffett add more in February, increasing his total position at the energy company to 264.9 million shares.

Reduction and prominent exits

Buffett and Berkshire are known for their long-term investments, but they closed short-lived positions in the last quarter. The company ended its position at Ulta Beauty (Ulta) after buying in the second quarter and loading more than 96% of its shares in the third quarter.

The only other positions that Berkshire finished its final quarter were small investments in the SPDR S&P 500 ETF Trust (SPY) and the Vanguard S&P 500 fund.

Buffett’s sale of Bank of America (BAC) stake was headlined last year, and that trend continued in the last quarter. Berkshire offloaded another 117 million shares, and now owns around 680 million shares, or almost 9% of the bank.

And that’s not the only financial sector investment Buffett has pulled back. Berkshire has sold 40 million shares of Citigroup (C), 46 million shares of digital banking platform NU Holdings (NU), and 1.65 million shares from Capital One (COF). We also trimmed stocks in Charter Communications (CHTR), T-Mobile US (TMUS), and Louisiana Pacific (LPX).

Another filing on Thursday revealed that Berkshire has acquired position at Davita Inc. (DVA) and sold about 200,000 shares this year, but owns nearly 45% of the healthcare company. I’m continuing.