CFRA Equity Research Director Ken Leung and Michael Lee Strategy Founder Michael Lee discuss bank earnings and rising interest rates on “Morning with Maria.”

Goldman Sachs CEO David Solomon expects the next administration to take a more pro-business approach and shift its focus to deregulation.

This, he argues, will stimulate economic growth and benefit businesses across the country.

“The regulatory pendulum has swung quite a bit over the last three or four years,” Solomon said during a discussion at the National Retail Federation’s 2025 Retail Big Show. As a result, CEOs have been forced to hold back on investments due to regulatory pressures, Solomon said.

“The current administration is sending a clear message that it wants to swing the pendulum back,” said Matt Shea, CEO of Solomord NRF. “This is very constructive for growth and investment.”

Walmart CEO Doug McMillon talks with Trump about trade relations and investment in the US

Mr. Solomon continued: “The trend toward deregulation is a very strong catalyst for investment.”

In a report released last month, New York investment firm Invesco highlighted how it expects a “highly deregulated environment” that could foster economic growth.

“Regulatory reforms, especially those that liberalize market entry, are likely to stimulate investment, whereas increased regulation of the industry is likely to deter investment,” the firm wrote. “Furthermore, a deregulated environment can have a psychological impact, unleashing ‘animal spirits’ not only in the economy but also in the market.

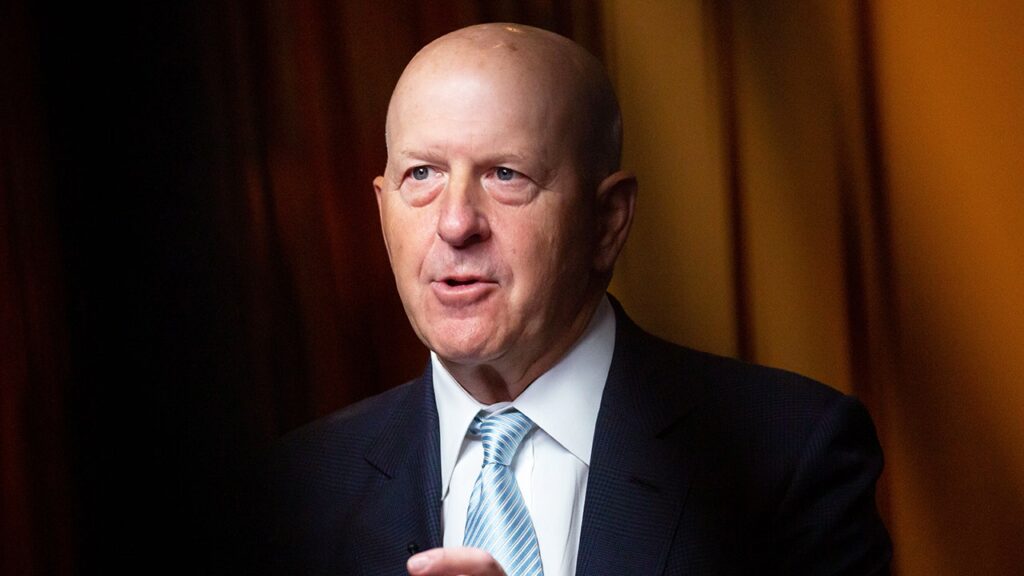

David Solomon, CEO of Goldman Sachs Group, appears on Bloomberg TV during the Goldman Sachs Financial Services Conference in New York, USA, on Tuesday, December 6, 2022. (Michael Nagle/Bloomberg via Getty Images/Getty Images)

But the Goldman Sachs chief warned that there would be a “cocktail of changes” once the new administration takes over and begins implementing policies, adding: “Some of it will be very constructive; some of it will be very constructive; There are also things that could slow growth.” I think what we need to look at very carefully is how it all balances out. ”

Fed Chairman Jerome Powell says central bank is in no hurry to reach ‘neutral interest rate’

After President-elect Donald Trump’s victory in November, Goldman Sachs released forecasts for the U.S. and global economy that highlighted how the Trump administration’s planned tax cuts would boost growth. More aggressive tariffs could dampen that impact.

The Goldman Sachs logo can be seen on the trading floor of the New York Stock Exchange (NYSE) in New York City, USA. (Reuters/Andrew Kelly/File Photo/Reuters Photo)

Economists at Goldman Sachs, led by Jan Hadzius, predict that the U.S. economy will grow by about 2.5 in 2025, assuming a second Trump administration will bring new tax cuts, deregulation, immigration cuts and higher product tariffs. expected to grow by %. Cars imported from China.

Their basic plan does not include a 10% tariff on all imports or a deportation program that President Trump campaigned on, but both could have the effect of curbing economic growth if implemented. .

Ticker Security Last Change Change % GS The Goldman Sachs Group 626.00 +13.23 +2.16%

“We think there are some offsetting effects, negative effects from tariffs and immigration, positive effects from fiscal policy and regulatory changes. And when you plug this into the model, you get some offsetting effects, but the net effect is It’s not that big,” Hadsius previously said.

FOX Business’ Eric Revell contributed to this report.