Intel (NASDAQ:INTC) stock soared nearly 9% on Friday as rumors of a possible acquisition reignited investor excitement. Technology news site Semiaccurate sparked the uproar by claiming to have reviewed and verified emails detailing a company-wide takeover bid.

Stay ahead of the market:

Whispers of acquisitions are nothing new for Intel. Back in September, the Wall Street Journal reported that Qualcomm had floated the idea of a friendly takeover. However, by November, rumors suggested Qualcomm’s interest had “cooled down.”

JPMorgan analyst Christian Crosby doesn’t think the market should be shocked by the continued interest in Intel. After all, the company’s stock price has plummeted 54% over the past year, its CEO abruptly resigned, and its ratings have been downgraded multiple times. Additionally, Intel is in the midst of a major transformation as it aims to become a major player in integrated chip design and manufacturing. In recent moves, the company has sought buyers for non-core assets like Altera, announced the separation of its venture capital arm, and is also working on a legal separation of its foundry division.

Among the strongest competitors, Qualcomm remains the standout, Crosby said. The chipmaker’s interest thus far highlights how Intel’s capabilities could help the company diversify its business, especially as Apple’s influence as a major customer declines. The addition of Intel’s foundry expertise could strengthen Qualcomm’s competitiveness and create a semiconductor powerhouse.

But that’s not the only topic. Enter Elon Musk, the wild card in this unfolding story. Crosby speculates that Musk, whose ventures like Tesla, SpaceX and xAI require vast amounts of semiconductors, has a vested interest in Intel’s assets. However, not everyone agrees with this idea.

“While some investors are understandably concerned about the scope for more aggressive financing similar to the Twitter acquisition, we believe that the funding behind other companies in his portfolio is He countered that power is far more important. 1) SpaceX – recently valued at $350 billion, not disclosed. 2) Tesla has a market capitalization of $1.3 trillion and net cash of $200. 3) xAI – recently valued at an undisclosed $50 billion. That said, there is a lot of uncertainty about how the deal will play out here. Not to mention more influence on Intel (whether foundry or design) We are mindful of the fact that there is little strategic benefit in adding , and we believe it will solve some problems. Dealing with the richest individuals in the country could mean improved credit. is high,” Crosby opined.

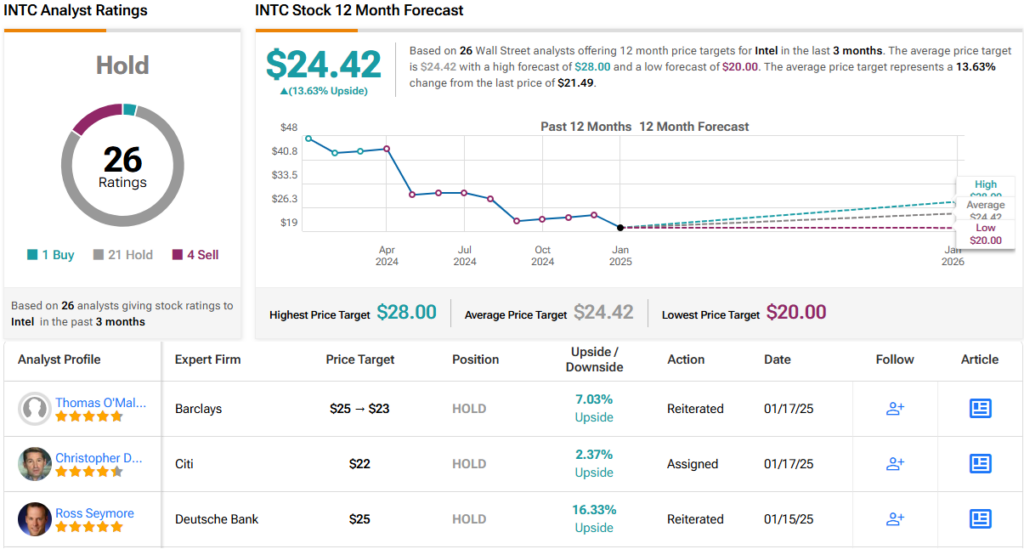

Overall, the outlook for Intel doesn’t seem very positive among Wall Street analysts at the moment. There are 21 holds, 4 sells, and 1 buy, giving the stock a consensus rating of Hold (i.e. Neutral). However, the average price target of $24.42 suggests an upside potential of ~14% from the current stock price. (See INTC stock price forecast)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.