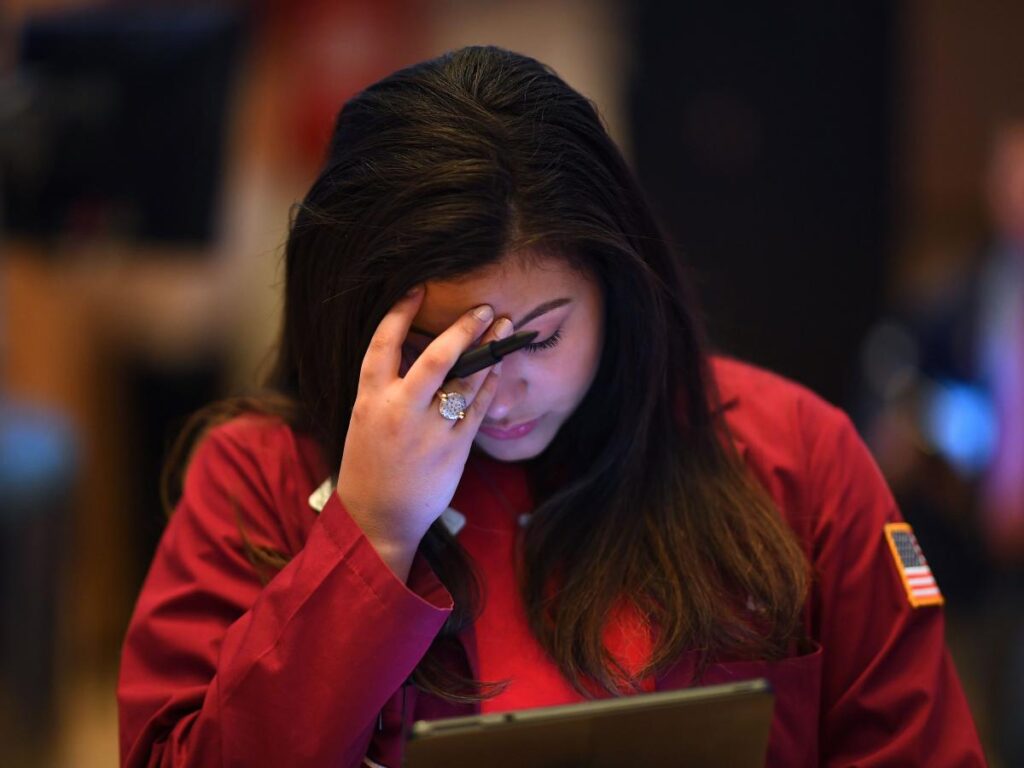

U.S. stocks fell on Friday after a strong December jobs report dampened expectations for a Fed rate cut in 2025.

The economy added 256,000 jobs in December, more than expected, and the unemployment rate fell to 4.1%.

A rise in bond yields could lead to a correction in the stock market.

U.S. stocks fell sharply on Friday after a strong December jobs report dashed investors’ hopes for further interest rate cuts from the Federal Reserve this year.

The Dow Jones plunged 697 points, and the Nasdaq 100 and S&P 500 fell more than 1%.

Employment rose by 256,000 in December, well above the average economist estimate of 155,000. The unemployment rate unexpectedly fell to 4.1% from 4.2% in November.

Bond yields rose on the positive employment report, with the 10-year U.S. Treasury yield soaring to its highest level since October 2023, hitting an intraday high of 4.79%.

Markets currently expect the Fed to cut rates by just one 25 basis point (bp) this year, according to the CME FedWatch tool, but economists think even that forecast is too rosy.

“Given the resilience of the labor market, we now believe the Fed’s rate-cutting cycle is over. Inflation remains above target and risks are skewed to the upside,” Bank of America economists said. “Economic activity is strong. There is little reason for further easing.” On Friday’s note.

Wharton University professor Jeremy Siegel supported that view in an interview with CNBC on Friday.

“I think the market is saying there probably won’t be a rate cut in 2025, and the 10-year rate could easily go well above 5%,” Siegel said.

Siegel emphasized that historically rising bond yields have depressed stock market valuations, so it would not be surprising if the stock market experienced a correction this year.

Here are the U.S. indices as of Friday’s close at 4 p.m.

Here’s what else happened today:

In Commodities, Fixed Income and Cryptocurrencies:

West Texas Intermediate crude oil rose 3.58% to $76.57 per barrel. Brent crude oil, the international benchmark, rose 3.60% to $79.69 per barrel.

Gold rose 0.92% to $2,715.50 an ounce.

The 10-year Treasury yield rose 9 basis points to 4.778%.

Bitcoin rose 2.77% to $95,112.

Read the original article on Business Insider