(Bloomberg) — Mondelez International’s latest offer for Hershey Co. highlights the challenges posed by soaring cocoa prices and penny-pinching consumers, making the chocolate company more open to a deal than it was eight years ago. There is a possibility. .

Most Read Articles on Bloomberg

Bloomberg reported this week that Mondelez had taken a preliminary approach about a possible combination. If the deal goes through, it would create a food group with combined sales of about $50 billion and pose a bigger challenge to Mars, one of the world’s largest confectionery makers. The issue largely falls to the Hershey Trust, which controls about 80% of the company’s voting stock.

A lot has changed since 2016, when Chicago-based Mondelez, the maker of Ritz crackers and Oreo cookies, last made a $23 billion bid that Hershey Co. rejected.

Mondelez, Hershey, and Family Trust all have different CEOs. Both companies face a food market disrupted by inflation, new weight-loss drugs and rising cocoa costs that are squeezing chocolate companies’ profit margins. Now more than ever, there is a strategic rationale for large packaged food companies to scale up and diversify their portfolios.

That logic also drove Mars’ agreement to buy Keranova in August for about $36 billion, the biggest deal of the year so far. With the addition of the maker of Pringles and Nutrigrain bars, the M&Ms and Snickers owner has pushed further into snacks, which are growing faster than sweets.

The Mars-Keranova partnership has increased pressure on Mondelez, led by Chief Executive Officer Dirk van de Put, to increase capacity to become more competitive.

“It’s clear that both confectionery and snacks are going to be dominant players and need to compete effectively,” said Arun Sundaram, an analyst at CFRA Research.

Mondelez also has an extensive distribution network, Sundaram said. “Their products are everywhere, in convenience stores and airports,” he says. “If they buy Hershey, they will immediately expand their distribution.”

A representative for Pennsylvania-based Hershey & Mondelez said the company does not comment on market rumors.

Mondelez on Wednesday approved up to $9 billion in share buybacks and said it would pursue an “acquisition strategy focused on bolt-on assets.”

cocoa price

the story continues

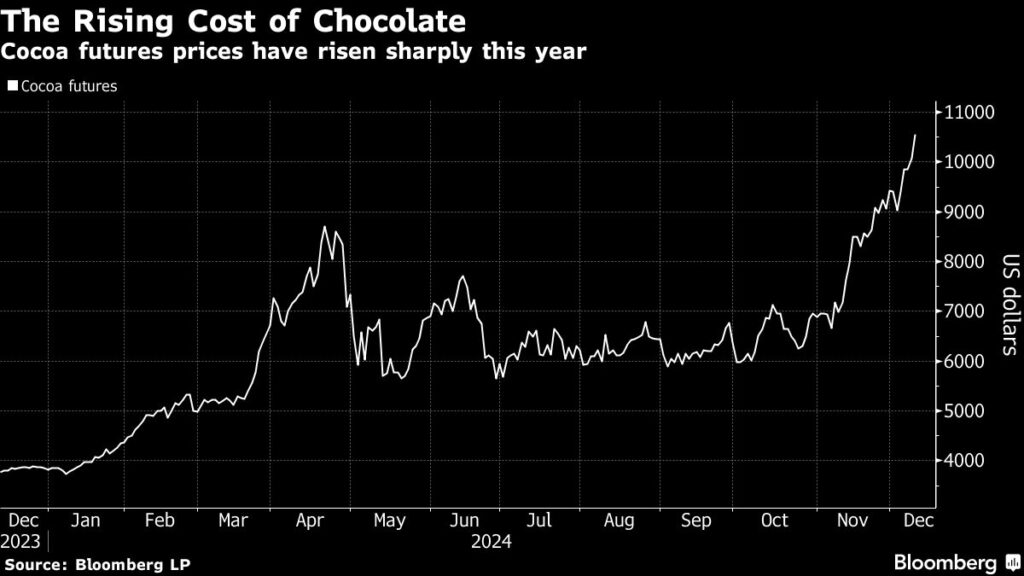

Hershey has been particularly hard hit by soaring cocoa prices, with its most traded contract this year up about 150%. Analysts expect Hershey’s gross profit margin to fall to below 42% this year from 45% last year.

Chocolate accounts for more than 88% of the company’s sales, according to Bloomberg Intelligence. In the company’s latest earnings call, chief financial officer Steve Voskuil said the company was considering “pretty significant increases” in cocoa prices next year.

Chocolate accounts for less than one-third of Mondelez’s sales. The willingness to push further into that market may be a bet that cocoa prices will eventually ease. Chief Financial Officer Luca Zaramella said at an earnings conference in late October that the economy is expected to return to normal by 2026.

Even if market volatility continues, increasing the size and diversification of markets and suppliers could help the combined company weather the ups and downs.

The rise of GLP-1

Other potential challenges include growing consumer preferences for healthier foods and the rise of GLP-1 drugs such as Novo Nordisk A/S’s Ozempic and Wigovy to help fight diabetes and help people lose weight. can be mentioned.

Van de Putte has repeatedly said he believes the company is largely insulated. The company’s data shows that even though consumers are seeking more portion-controlled snacking, “consumers strongly believe that snacking plays an important role in active, busy lifestyles.” he said in February. In a subsequent interview with Bloomberg TV, he predicted that the GLP-1 drug’s impact on the amount of food sold by Mondelez would be between 0.5% and 1%, calling this the “margin of error.” is.

Hershey CEO Michelle Bach is taking a slightly more cautious stance. In November, she said the drug was causing “mild” and “gradual effects” but added that users were “not disproportionately reducing our category’s diet.” .

complementary brands

By combining the two companies, we can reduce costs and have complementary geographic locations. In addition to Toblerone and Milka bars, Mondelez also makes Ritz, Triskate, and Wheat Thins crackers. Only about 30% of its net revenue comes from North America, according to its latest financial report.

Although Hershey has diversified by acquiring Skinny Pop and Dots Pretzels, it remains primarily a North American chocolate company. Sundaram said the strength of top brands such as Kissu’s, Reese’s and KitKat makes them less susceptible to private label growth.

Political developments could also influence the timing of interest in Mondelez, if President Donald Trump’s election makes the Federal Trade Commission more receptive to large deals than it has been in recent years. Still, Bloomberg Intelligence analyst Jennifer Bartashius said any deal would likely be subject to careful scrutiny by regulators because the companies’ product portfolios overlap.

The combination would give Mondelez 16% of the global confectionery market and 27% of the North American market, higher than Mars’ share in both cases, according to Euromonitor data cited by Bloomberg Intelligence.

Related: Mars preparing to sell bonds early next year for Keranova deal

In 2016, the Hershey Trust ultimately blocked the Mondelez acquisition. The organization, whose mission is centered around preserving the legacy of its founders through institutions such as the Milton Hershey School, recently welcomed a new CEO and is making significant changes to its portfolio and new board members. It shows an open attitude.

There’s another potential hurdle. Under Pennsylvania law, the state attorney general can block transactions that result in a trust losing voting rights if it is deemed “unnecessary to the future economic viability” of the company.

Billy Roberts, senior food and beverage economist at Corbank ACB, said even potential interest from Hershey management “may not be strong enough to withstand some of the very same challenges to the deal that existed in 2016. ”, pointing out the points made by the Hershey Trust. mission. “Those responsibilities still exist.”

(Updated Hershey’s profit margin, Mondelez buyback plan)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP