Global airfare increases in most regions except Australia will remain stable in 2025, starting in 2024, according to American Express Global Business Travel’s Air Monitor 2025 report released on Monday. This trend is expected to continue.

In the report, travel management companies cited slowing leisure demand, increased transport capacity, geopolitical tensions that may impact fuel costs, and charges such as environmental surcharges and new global distribution system fees. It also noted continuing trends that could impact pricing in 2025, including price hikes and increased labor costs. This is due to new contracts and the continued adoption of new distribution capabilities by airlines.

Regarding the latter, as the use of NDC increases, advanced pricing strategies such as dynamic pricing will emerge, allowing airlines to offer more price ranges and adjust their pricing based on supply and demand, market conditions, competitors’ fares and ‘willingness’. Airfares can be adjusted based on situational information such as,” the report said. ”

“In 2025, companies will face a new reality in their aviation programs, even though price increases have leveled off and capacity has returned,” Gerardo Tejado, senior vice president of Amex GBT Professional Services, said in a statement. “Fares will remain high.” “Businesses should expect tough negotiating positions from airlines, especially as airlines evolve their distribution models. Business travel buyers are looking to gain value in this environment by focusing on loyalty and program We need to think strategically about things like performance data.”

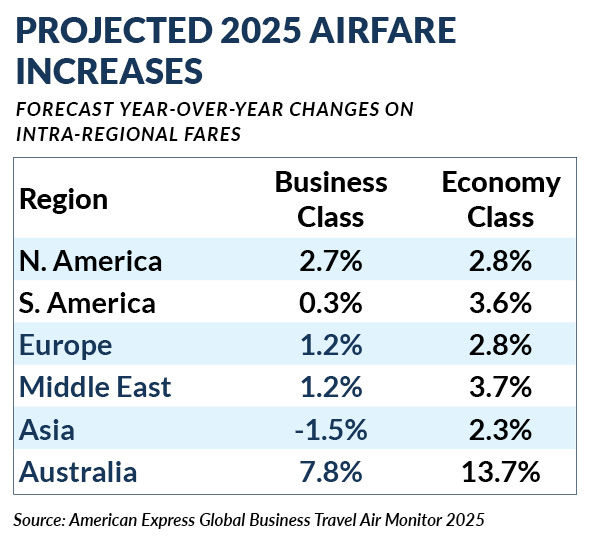

Travel management companies predict that business class fares in 2025 will rise 2.7% year over year in North America and 1.2% in Europe. Economy class fares in each region are expected to rise by 2.8%.

Intra-regional South American business class fares are expected to rise by just 0.3% year-on-year, while economy class fares are expected to rise by 3.6%. Asia is the only region where business class fares are expected to fall by 1.5%, while economy class fares are expected to rise by 2.3%.

Australia is expected to see the biggest fare increases for intra-regional travel, with business class fares expected to rise 7.8% and economy class fares 13.7% year-on-year.

Forecasting freight rates between regions is even more complex. Business class fares between North and South America are expected to decrease by 1% compared to 2024, and economy class fares by 8%. Fares increases between North America and Europe are expected to be modest, with business class fares expected to rise by 1.5% and economy class fares by 0.8%. Fares between Europe and the Middle East are expected to rise by 6.8% in business class and 6.7% in economy class.

The report also notes that airlines and technology providers are using AI to “enhance revenue management and retail capabilities.” Examples include British Airways partnering with Amadeus to design an AI-powered offers and ordering feature, and Delta Air Lines’ “determining whether consumers are willing to pay for an airline’s premium products.” This includes looking at how AI can be used in pricing. This is the basic fare. ”

Amex GBT used Prophet time series modeling to generate aviation price forecasts. Data for the analysis came from Amex GBT’s “data lake” as well as the International Monetary Fund’s inflation and gross domestic product forecasts.

Amex GBT plans to stabilize global airfares in 2024