The selection of Scott Bessent as the next Treasury secretary has helped global currencies accelerate their rise against the dollar, as traders believe Donald Trump’s return will cause turmoil across global markets. There is.

A gauge of the U.S. currency fell 0.6% on Monday, the biggest decline in two weeks, with the yen and euro the best performers among major currencies. The South Korean won and Eastern European currencies led the rise in emerging currencies, recovering some of their losses following President Trump’s victory.

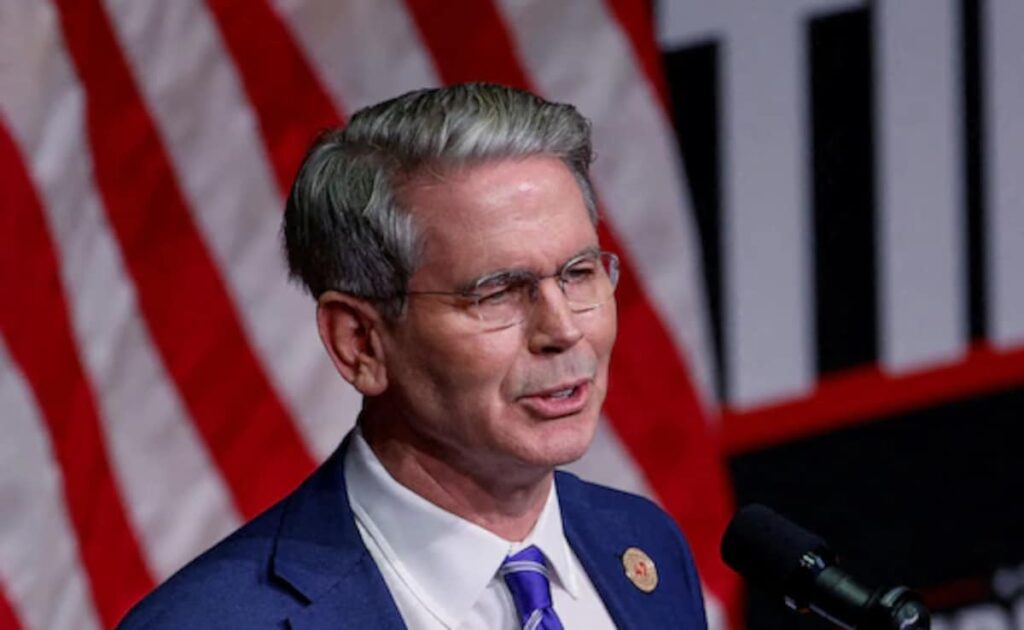

The move underscores traders’ relief at the selection of Bessent, a Wall Street veteran whose cautious approach could soften some of the pain of President Trump’s “America First” policies. There is. Bessent has called for a phased approach to imposing trade restrictions and is open to negotiations on the exact size of the tariffs.

Stephen Spratt, a strategist at Société Générale in Hong Kong, said the market’s view that Bessent is a “safe” candidate reflects the risks of a more unconventional and less qualified candidate. I wrote that the price of government bonds may be expected to rise. Note to client. Mr. Spratt said that Mr. Bessent’s view that tariffs should be imposed in stages and that the levies currently being discussed could be lowered by a “maximalist” position, meaning they could be lowered through negotiations, He said it should support.

U.S. Treasuries rose above the curve in early trading, with the benchmark 10-year Treasury yield dropping 5 basis points to 4.35%, the lowest in a week. This is also a factor in weakening the momentum of the dollar’s appreciation. On Friday, the Swiss franc posted its biggest weekly gain in more than a year, the euro fell to a two-year low and the Swiss franc fell to its lowest since July.

Market participants surveyed by Bloomberg after Mr. Bessent took over said they saw the hedge fund manager taking a more gradual approach to tariffs and trying to contain the budget deficit. While this is a positive sign for the U.S. economy and markets, it may also ease some concerns about the impact of Trump’s return on other countries’ economies and currencies.

Bessent must be approved by the U.S. Senate before taking office, but former Federal Reserve member Kevin Warsh and Trump transition co-chairman Howard Lutnick, who was supported by Elon Musk, He defeated other prominent candidates such as. His nomination follows a series of unconventional candidates and others for other key positions, including Secretary of Health Robert F. Kennedy Jr. and Attorney General Matt Gaetz, who later withdrew. This contradicts Mr. Trump’s choice to be an absolute supporter.

Richard Franulovich, head of foreign exchange strategy at Westpac Bank, said Bessent’s appointment was “based on a new view that the tail risks of a radical Trump policy departure are overestimated”. . The election of John Thune as Senate president over Trump’s choice reinforced the message that checks and balances can temper Trump’s radical policy proposals. ”

Still, the dollar’s gains over the past eight weeks are unlikely to be completely erased. Traders are dialing back hopes that the Federal Reserve will ease in 2025 on fears that inflation will accelerate in the strong U.S. economy. Speculative traders raised bets on the dollar’s strength to their most bullish levels since late June in the week ending Nov. 19, according to data from the Commodity Futures Trading Commission.

“The current reaction could lead to a correction in the dollar in the near term if U.S. yields fall,” said Felix Ryan, an analyst at ANZ Banking Group in Sydney. “But ultimately, as highlighted by Friday’s November PMI data, the fundamental dynamics of strong US growth contrasting with slower EU and global growth remain strong and the US dollar remains well supported. We see this as supporting evidence that there is.”

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)