President-elect Trump is likely to put pro-business leaders in charge of key government agencies and reduce regulatory burdens. Great news for banks and traders.

Written by Hank Tucker, Forbes Staff

Banks and alternative investment firms were the biggest winners as investors celebrated Donald Trump’s decisive victory in last week’s presidential election, hoping for less regulation.

Goldman Sachs soared 12% in the last three days of the week, while peers such as JPMorgan, Citigroup, Morgan Stanley and Bank of America, as well as private equity giants KKR and Apollo, were all up at least 7%. rose. The rally also extended to smaller banks, with the KBW Regional Bank Index up 10% in the period as financials pushed the S&P 500’s 3.7% gain in the final three days of the week to a new all-time high.

The reaction was a sign of glee and hope that Trump would add a Wall Street-sympathetic Treasury secretary to his Cabinet and replace tough regulators like the Securities and Exchange Commission and the Federal Trade Commission. Mr. Trump will win once all votes are counted in the close House race, and with a likely Republican victory in Congress, the generous corporate tax cuts he enacted during his first term will expire at the end of next year. There is a growing possibility that this will be extended.

“This is a highly regulated industry, so any loosening of government regulations would be a positive,” said Stephen Biggar, director of financial institutions research at Argus.

Since the global financial crisis, banking regulations have been significantly tightened around the world as part of a framework established by the Basel Committee on Banking Supervision to reduce the risk of bankruptcies and bank failures. The so-called Basel III end-game rules, scheduled to go into effect next summer, initially raised capital requirements for large banks by 19%, but were met with fierce resistance from industry leaders — J.P. Morgan CEO Jamie Dimon said many of the rules were “flawed and poorly coordinated.” The Fed raised interest rates back to 9% in September. Now, Citigroup CEO Jane Fraser said in an interview with CNBC on Friday that she expects the requirements to be further relaxed.

“I think this is a turning point in banking regulation. The post-GFC era is over,” said Mike Mayo, a longtime banking analyst at Wells Fargo. “The pendulum was already starting to swing back, and it could start to swing back even further.”

Eased capital requirements will allow banks to make more loans and earn more interest, and an expected increase in M&A activity will also boost capital market gains for Wall Street’s biggest investment banks. It will push it up. Total M&A activity in 2023 fell 17% to about $3 trillion, and although it has rebounded slightly this year, it is still far from the peak the investment banking sector enjoyed in 2021.

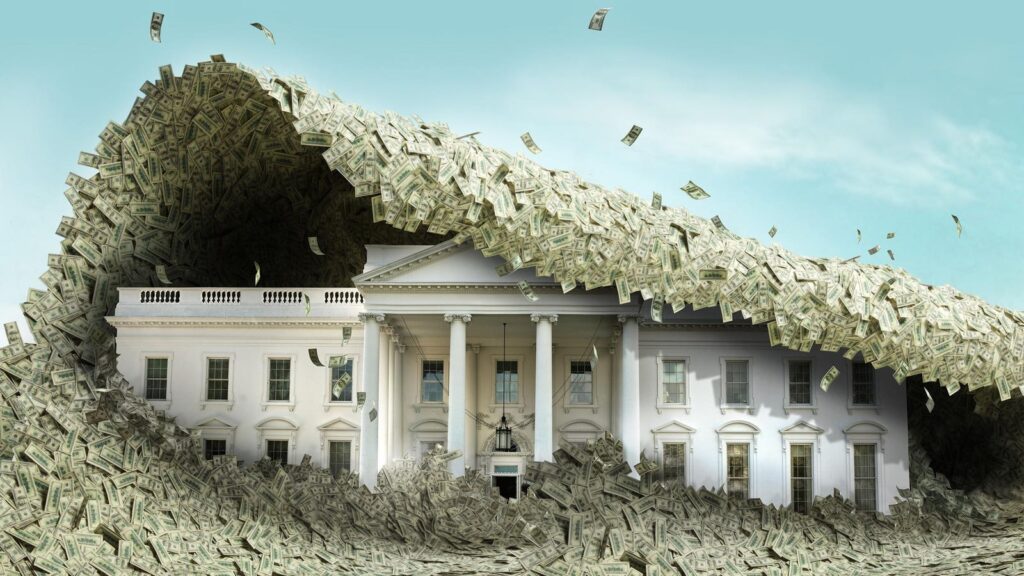

Private equity firms and acquisition-minded companies were already preparing for a big window in 2025 when interest rates are expected to fall. PE firms around the world have $2.6 trillion worth of dry powder at their fingertips, according to S&P Global, but the incoming Trump administration poses some risk. Investors expect the budget deficit to remain high if tax cuts are extended, and that President Trump’s tariff threats could cause prices to rise again, leading to a return to inflation and higher interest rates. As a result, bond yields have already risen since the election.

“Unusually large tariffs, tax cuts, deficits, or other moves that push interest rates too high could quickly derail the bull market,” Mayo said. “If they prioritize populism over the economy, markets are likely to react very quickly to that.”

High interest rates have been a major culprit for the trading slump over the past two years, but bankers and politicians are also pointing fingers at Federal Trade Commission Chair Lina Khan. Mr. Khan has been praised by progressives like Bernie Sanders and Alexandria Ocasio-Cortez for challenging corporate monopolies, but has been criticized by conservatives for breaking deals and overseeing lengthy reviews. has been slandered.

SEC Chairman Gary Gensler, who will be nominated by Joe Biden in 2021, has also been a target of President Trump’s ire. Under Gensler’s leadership, the SEC has introduced dozens of new rules on topics such as ESG reporting requirements and stricter SPAC disclosures about sponsor compensation and conflicts of interest. Trump’s vow to fire Gensler was praised even by crypto evangelists because of his hard-line stance on digital assets, including lawsuits against exchanges Coinbase and Kraken.

“Generally accepted schedules for SEC registration statement reviews may be more strictly adhered to,” said Capital Markets’ Christian Nagler. It used to be a maximum of 28 days, with subsequent applications within two weeks,” said Capital Markets’ Christian Nagler. Partner at Kirkland & Ellis. “In recent years, those periods have gotten longer at times.”

The IPO market has also slowed since 2021, but Nagler said the number of IPOs has increased over the past four years immediately following a presidential election year, regardless of who wins, and the market is expected to do the same next year. He pointed out that it seems that they are expecting an increase. . The SPAC market has already started to recover this year, with 46 IPOs so far in 2024 compared to 31 in all of 2023, according to SPAC Insider data, compared to 31 IPOs in all of 2023, compared to the peak of the SPAC bubble. This is still far from the 613 cases in 2021. When many people performed poorly. Some of the beleaguered SPACs are still among the 95 blank check companies currently looking for acquisition targets.

“This is a once-in-500-year flood number and no one wants to go back to that…anywhere between 80 and 120[per year]is probably a healthy SPAC market,” Founder and Editor of SPAC Insider says Christy Marvin. “Many sponsor teams want to IPO now in anticipation of improved trading conditions in 2025.”

More from Forbes