Claman Countdown panelists Brian Gardner and Art Hogan unpack the economic outlook for 2024.

The red wave that propelled President-elect Trump to a second term has triggered a wave of green money among US investors.

On Friday, the Dow Jones Industrial Average and S&P 500 hit new record highs, rising 4.7% and 4.6%, respectively, ending their best week of the year. The Nasdaq Composite Index rose 5.7% for the week, setting the 31st record closing price of 2024.

Last change in ticker security Percent change % I:DJI Dow Jones Average 43988.99 +259.65 +0.59% SP500 S&P 500 5995.54 +22.44 +0.38% I:COMP NASDAQ Composite Index 19286.776974 +17.32 +0.09%

“Contrary to popular belief, under a Republican president, we don’t want gridlock. We don’t want a divided Congress. “Because the profits of the US have been exposed to a red wave, controlled by the Republican Party,” Sam Stovall, chief investment strategist at CFRA, said during an appearance on “Making Money with Charles Payne.”

“In that case, the market was up 13% a year on average and 75% of the time. So the scenario we have now is the best one for a Republican president.”

Republicans took control of the Senate this week. As of Friday night, Republicans lead in the race for control of the House.

FOX News: 2024 Election Live Results

Stovall also noted that small-cap stocks, which generate most of the domestic revenue and profits, are up an average of 14% a year in the red wave.

Republican presidential candidate and former President Trump gestures during a campaign rally at PPG Paints Arena in Pittsburgh on November 4, 2024. (Charlie Tribalew/AFP via Getty Images/Getty Images)

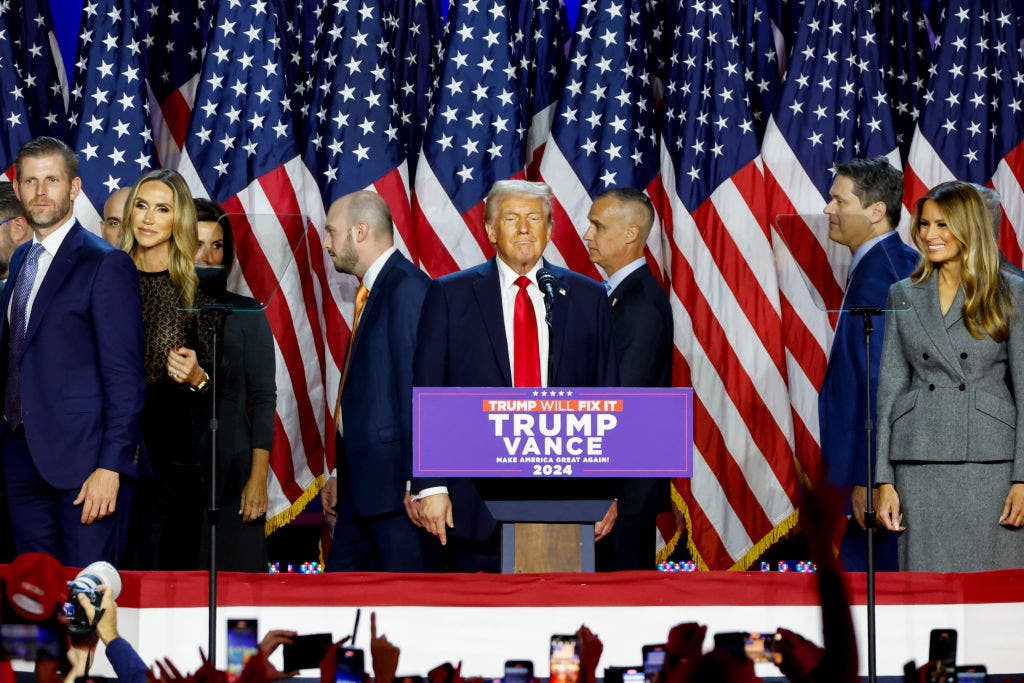

Trump won both the popular vote and the electoral vote, defeating Vice President Kamala Harris and cementing his position as the 45th president and the 47th president to come in January 2025.

How the White House could capitalize on Elon Musk’s empire

“Nothing will stop me from keeping my promise to you, the people. We will make America safe, strong, prosperous, powerful and free again. I ask you to join me in this noble and just endeavor,” President Trump told supporters early Wednesday morning.

Dow Jones Industrial Average

Stock futures soared during his remarks and continued to rise throughout the week. The Dow Jones Industrial Average soared an unprecedented 1,500 points on Wednesday, reaching 44,000 points for the first time late in the week.

“This is what deregulation and lower taxes look like,” Great Hill Capital Chairman Thomas Hayes said on “Berney & Company.” Wednesday.

President Trump’s planned policy promotion

Eliminate regulatory red tape in the housing industry, etc.

“Drill Baby Drill” to restore America’s energy independence

Extends the Tax Cuts and Jobs Act of 2017 to expire at the end of 2025

Reduce corporate tax rate from 21% to 15%

Reduce government waste with efficiency committees

President Trump has promised to cut regulatory red tape for industries such as housing and energy, using the slogan “Drill Baby Drill.” On taxes, his historic 2017 Tax Cuts and Jobs Act, which expires at the end of 2025, is likely to be extended.

He is also pushing to cut the corporate tax rate from 21% to 15% and create an “efficiency commission” with support from billionaire Elon Musk to cut government waste. .

Tesla CEO Elon Musk and former President Trump leave before an election event at the Butler Farm Show in Butler, Pennsylvania, October 5, 2024. (Justin Merriman/Bloomberg via Getty Images/Getty Images)

Stocks soar after Trump’s victory

Within the S&P’s major sectors over the past five days, consumer discretionary stocks rose 7.7%, industrials rose 6% and energy stocks rose more than 5%. Utilities and daily necessities lagged behind.

Ticker Security Last Change Change % XLY Consumer Choice Sector SPDR ETF 215.16 +3.04 +1.43% XLI Industrial Select Sector SPDR ETF 142.07 +1.45 +1.03% XLE Energy Select Sector SPDR ETF 93.75 +0.62 +0.67% XLU Utility Select SEC TOR SPDR ETF 79.17 +1.45 +1.86% XLP Consumer Staples Select Sector SPDR ETF 80.79 +0.96 +1.20%

The Fed also played a role in energizing stock prices by cutting interest rates by 25 basis points, suggesting the path to low rates is likely to remain.

“We’re on a path to a more neutral position and that’s exactly what we’re going on. That hasn’t changed at all since September. And, you know, we’re moving forward with data We just need to see where it goes.”You know, we need to look at six weeks’ worth of data to make that decision in December,” Fed Chair Jerome Powell said at a press conference Wednesday. said.

More than 64% of market participants say the Fed is likely to cut rates by another 25 basis points in December, according to CME’s FedWatch tool, which predicts future interest rate trends. There could be more in 2025.