THE FINAL election polls have been released, but in-person voting has not yet ended. These are uncertain times, and there is little new information to parse about who will win as America’s next president. But that doesn’t stop investors from making and adjusting their bets. From prediction markets to bonds, there are more ways than ever to express opinions about the likely outcome of an election. Most of their money is going to Donald Trump, but his perceived lead over Kamala Harris has narrowed in recent days.

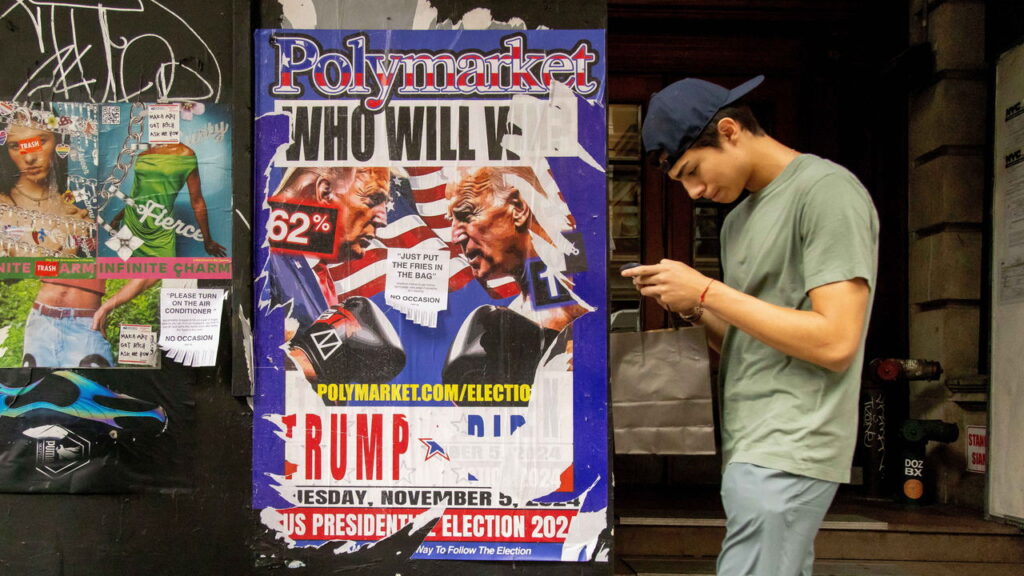

The easiest place to find out what voters think is the election betting market. Three of the most popular are Polymarket, Kalshi, and PredictIt. Polymarket, a cryptocurrency-based platform that bills itself as the world’s largest prediction market, gave Trump a roughly 60% chance of winning the election as of Monday afternoon. This is down from 67% last week and comes after several recent polls, particularly a surprising Selzer poll in Iowa, showed a more positive result for Harris. . However, the polymarket has many critics, with some claiming that its pricing is easily manipulated.

By contrast, PredictIt, the oldest of the three online betting marketplaces founded just 10 years ago, has the narrowest lead over Harris. However, it is also the most restricted platform by design, with strict limits on the number of bettors and bet sizes. Karshi, a regulated exchange, falls right in the middle. Trump now has a 56% chance of winning, down from 65% last week. In fact, shortly after the Selzer poll, Carsi briefly indicated that Harris was the favorite before swinging back toward Trump.

It may seem easy to dismiss these various platforms as silly betting venues for bettors, many of whom are young men who spend much of their waking hours online. However, it is surprising that its pricing closely reflects “real money” in more established markets. To get a sense of where stock investors stand heading into the election, analysts at investment bank Piper Sandler are looking at two stocks whose wealth could rise or fall depending on who wins the presidency. Created two separate portfolios. Their Trump portfolio includes shorts in oil companies, weapons makers, and companies like Apple that would be hurt by a trade war with China. Their Harris portfolio is focused on renewable energy and electric vehicle producers, while betting on financial and pharmaceutical companies that could face further regulation under a Democratic administration.

The performance of Piper Sandler’s portfolio is almost perfectly consistent with polymarket odds. In October, as gambling markets tilted against Harris, Trump’s portfolio rose about 3% and Harris’s fell 7%. But over the past week, that gap has narrowed. For example, prison operator Geo Group, which is part of Mr. Trump’s portfolio, is under selling pressure, while solar panel maker First Solar, which is part of Mr. Harris’ portfolio, is up. Research firm Citorini has produced similar results with its basket of stocks affiliated with Mr. Trump. Stocks soared after Mr. Trump survived an assassination attempt at a Pennsylvania rally in July, then plunged when Ms. Harris entered the race, only to recover after appearing to lose momentum. But on Monday, the first trading day after the Iowa polls, Citrini’s Trump basket was down about 1.4% by midday.

Election predictions are also influencing larger, more diffuse markets. U.S. Treasury yields and the value of the dollar have risen over the past six weeks as investors brace for President Trump’s inauguration. Their idea is that his policies, such as widening the federal deficit and raising tariffs, are likely to boost both growth and inflation. This background should, in theory, support the dollar, weigh on bond prices, and lead to higher yields. But those trends partially reversed on Monday, with both yields and the dollar falling slightly, reflecting Harris’ improved standing in the polls.

What should we think about all this trading? One conclusion is that investors are a highly uncertain group. Despite the ups and downs in election-related trading prices, opinion polls have been close throughout most of the campaign.

When you look at this volatility, the second conclusion is that investors pretty consistently have more faith in Mr. Trump’s chances than in the polls themselves. The Economist’s model rates this election as a real contest, based on polling and fundamental factors. Financial markets, from small investors in gambling exchanges to the giant institutions that set bond prices, support Trump at nearly 55%. It’s a coin toss, but it’s clearly against Harris.■

“The US in Brief,” a daily newsletter with quick analysis of the most important election news, and “Checks and Balance,” a weekly note from Lexington columnists that examines the state of American democracy and important issues. Stay up to date with politics. voters.