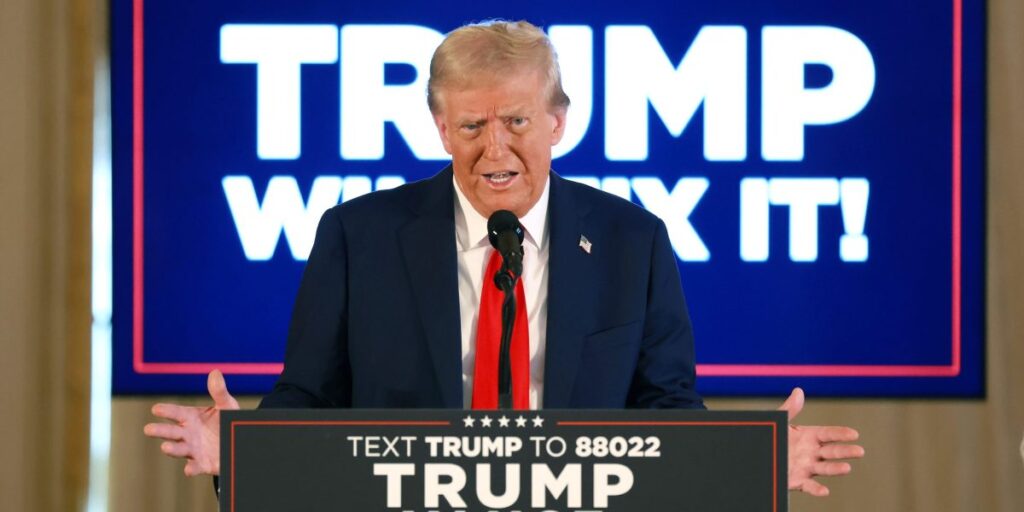

Economists expect inflation to rise if former president and Republican candidate Donald Trump is elected next week. Research firm Capital Economics actually plans to raise its interest rate forecast in such a scenario, as economist Thomas Ryan doubts the Fed’s reaction will push back on rate cuts.

“If he’s elected, we’re going to raise our Fed expectations by about 50 basis points,” Ryan said, referring to the interest rate at which banks and other institutions lend money to each other.

With less than a week left until the presidential election, the housing industry remains stagnant. Two candidates have plans or concepts for housing. But inflation plays an important role. Even while real estate acts as a hedge against inflation, inflation can push up prices. The consumer price index rose just 2.4% in September compared to the same month last year, very close to the Fed’s target. Needless to say, the central bank entered a rate cutting cycle that month, cutting key interest rates by 50 basis points. So, while you may think the worst is over, it may not be.

In June, 16 Nobel Prize-winning economists signed a letter expressing concern that President Trump’s proposals could reignite inflation. Earlier this month, 68% of economists polled by the Wall Street Journal said inflation would likely be even higher under President Trump. Meanwhile, 12% said the same about President Kamala Harris. Rampage inflation is kind of what got us into this mess. In other words, it’s a frozen housing environment. Home prices were already soaring during the pandemic, but as inflation reached a 40-year high and the Fed was forced to raise rates aggressively, mortgage rates indirectly followed suit. The housing market was paralyzed.

If Harris were to win, the most likely scenario would be a Republican-controlled Senate. If that happens, “it’s a policy status quo,” Moody’s chief economist Mark Zandi told Fortune. “Nothing meaningful changes in terms of tax policy, spending policy, regulatory policy. So the current rate of inflation will be the same as it is now, consistent with the Fed’s goal.”

But if Trump were to win and serve another four years, Republicans would likely take control of the House and Senate, Zandi said. This means Mr. Trump will receive a tax cut, but Mr. Zandi said most of the tax cut would be deficit-funded. President Trump could move forward with his tariffs and immigration proposals through executive orders, even if they are not all-inclusive. “Under any scenario regarding the composition of government, it is very likely that inflation will be higher under the Trump administration,” Zandi said.

Ryan agrees with Zandi. Trump’s proposed policies are still inflationary, especially regarding tariffs, immigration and tax cuts, he told Fortune. President Trump has proposed imposing a 60% tariff on all imports from China and a flat 10% tariff on imports from all countries. And Ryan said his immigration policy is almost entirely about mass deportations of illegal aliens, which drains the labor supply. “That’s why there’s so much discussion about whether his second term will be inflationary,” he explained. Still, depending on the situation in Congress, President Trump’s policies may be toned down.

Either way, both economists agree that consumer prices will rise under the Trump administration. Well, that suggests the Fed’s first step is to halt rate cuts. Zandi believes that if Trump wins, the central bank will immediately pause rate cuts, just to see what happens. It is possible that the Fed will raise interest rates again if necessary, but it is more likely that interest rate hikes will be put on hold for some time.

But as economists predict, Harris’ election won’t change anything, so “the economy today is the economy one year from now,” Zandi said. In Ryan’s mind, the policies proposed by Harris are “not inflationary,” but he does mention deficit spending. Still, he doesn’t think a Harris presidency will force the Fed to change course.

That’s not to say that everything would be perfect if Harris were president, but it probably won’t be and the housing issue will still be pretty much in limbo. Maybe it will recover a little. Mortgage interest rates may also come down a bit. But hopes that Trump will become president again have already materialized, and the situation could get even worse if he wins.

Mortgage rates have plummeted in anticipation of the first and only interest rate cut ever by the Federal Reserve. That’s no longer the case. they are recovering. The most recent daily reading of the 30-year fixed rate average was 7.09%. Zandi said part of that has to do with the “Trump trade,” or the expectation that Trump will win, which will lead to higher inflation and higher budget deficits. It is already having an impact on mortgage rates. ”

Ryan also mentioned the “Trump trade.” As his betting odds rise, so too do the 10-year Treasuries, which will impact mortgage rates. Even if Trump actually wins, some of that is priced in, so it’s not entirely clear whether the rally will continue, but it could happen. Needless to say, the market will also be keeping an eye on the composition of Congress, which could lead to some fluctuations.

The higher mortgage rates rise, or the longer mortgage rates last, the more locked the housing market becomes. Needless to say, when prices are high, not many people will forgo a lower interest rate and sell for a much higher rate. On top of that, the existing housing shortage makes it nearly impossible to buy a place to live on your own. Higher mortgage rates, or even interest rate changes, won’t help. Sadly, if you missed out on the brief period before the Fed cut, you may not want to lock in right away. Even if there is a recovery in the housing industry over the next year or two, “it’s going to be a little shallower under Trump’s presidency,” Ryan explained.